The price of gold reached $1765 twice last week after falling to the support level of $1722, the lowest price in nearly two months. Trading this week will start stable around $1760, at a time when the markets are awaiting the announcement of US jobs numbers, whose results affect the current market expectations towards the approaching date of tightening the policy of the US Federal Reserve.

Gold is trading affected by the reaction of the US dollar by announcing that the US Consumer Confidence Index in Michigan for the month of September exceeded expectations at 71 with a reading of 72.8. Moreover, personal spending grew 0.8%, beating expectations of 0.6% while personal income rose 0.2%, missing the estimate of 0.3%.

The latest US manufacturing data impressed after the ISM Manufacturing PMI beat expectations at 59.6 with a reading of 61.1, after rising from the previous month's reading of 59.9. The Manufacturing Prices Paid Index of 81.2 was much better than the forecast of 78.5 while the New Orders Index reading of 66.7 narrowly exceeded the forecast of 66. On the other hand, the ISM Manufacturing Employment Index narrowly missed the forecast of 50.9 with a print of 50.2. Prior to that, US annual GDP for the second quarter was reported to have exceeded expectations, while initial and continuing US jobless claims disappointed.

In general, the price of gold settled near its lowest level in seven weeks after US lawmakers struck a deal to avoid a US government shutdown. Silver was also flat as it headed for its worst monthly performance in a year.

The price of gold recorded its biggest monthly loss since June, as precious metals came under pressure from the possibility of a decline in stimulus measures. Recently, Federal Reserve Chairman Jerome Powell and his counterparts in Europe, Japan and Britain expressed cautious optimism last week that the supply chain disruptions that have raised inflation rates around the world will eventually prove temporary. This could ease some of the concerns about raising interest rates to combat rising prices.

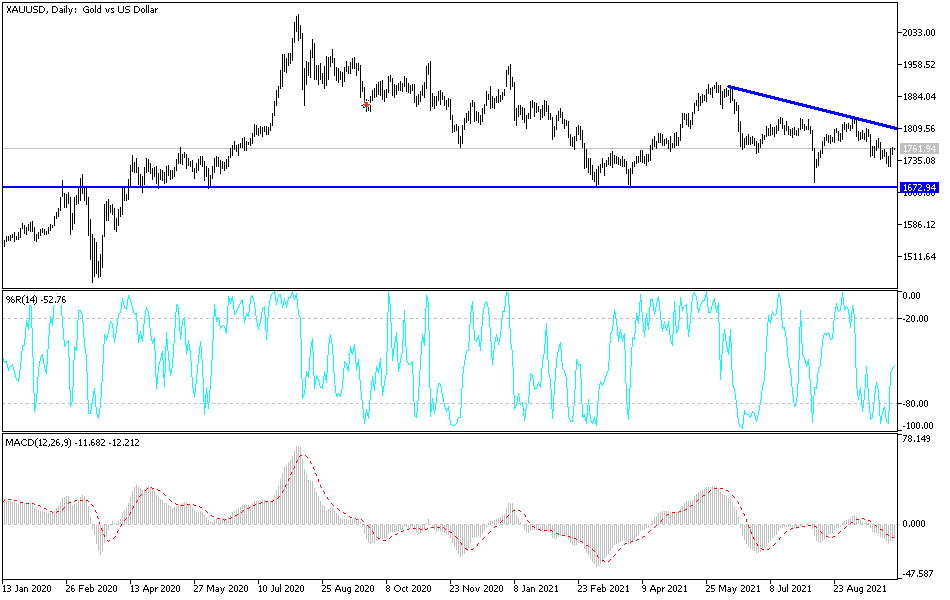

Technical analysis of gold prices

In the near term, and according to the performance of the hourly chart, it appears that the price of XAU/USD is trading within the formation of a bearish channel. However, the price of gold appears to have picked up recently after a significant change in market sentiment. Therefore, the bulls will look to extend the current rally towards $1,782 or higher to $1,804 an ounce. On the other hand, the bears will target short-term profits at around $1,742 or lower at $1,721.

In the long term, and according to the performance on the daily chart, the price of gold continues to trade within the formation of a descending channel, although it rebounded recently from oversold levels. Moreover, gold is below the 100-day moving average. Therefore, the bears will be looking to retain control of the gold price by targeting profits around $1,680 or lower at $1,594 the other hand, long-term bulls will target long-term profits at around $1,853 or higher at $1,933.

I still prefer buying gold from every bearish level. I expect quiet trading today in narrow ranges.

Technical analysis of the gold price today