Gold futures rose after the US government announced that US consumer prices rose more than expected. Accordingly, the yellow metal may be on track to achieve its best performance in one session in several months, supported by weak Treasury yields and a weaker US dollar. The price of an ounce of gold moved towards the resistance level of $1796, achieving gains of about $40 dollars in yesterday’s session alone, and settled around the $1790 level as of this writing. Gold prices have been disappointing in 2021, falling by 6% year-to-date. But the precious metal is up 1.7% this week.

Silver, the sister commodity of gold, is experiencing a breakout session. Silver futures advanced to $23.175 an ounce. The price of the white metal is down 13% this year, but silver prices are up more than 2% this week.

On the economic side, according to the US Bureau of Labor Statistics (BLS), annual US inflation rose to a 13-year high of 5.4% in September, slightly above the average estimate of 5.3%. Core inflation, which is decimating the volatile food and energy sectors, was unchanged at 4% on an annual basis last month. The skyrocketing price of food and energy contributed to the sky-high inflation level. In the twelve months to September, food inflation rose 4.6%, while energy prices rose 24.8%. Despite the month-on-month decline, prices for new cars and apparel were up 8.7% and 3.4%, respectively.

Shelter costs rose 3.2% year-on-year last month, while transportation services remained hot at an annual rate of 4.4%. On a monthly basis, the Consumer Price Index (CPI) rose 0.4%, above the 0.3% estimate.

The minutes of the last meeting of the Federal Reserve (FOMC) from this month's meeting were released, which offered some ideas about what the US central bank would do about monetary policy to close out 2021. However, both the White House and the Federal Reserve insist that inflation is temporary, although officials have acknowledged that high price inflation will continue into the next year.

The US bond market was mixed in the middle of the week's trading, as the 10-year yield fell 0.028% to 1.552%. Yields for one-year notes were unchanged at 0.099%, while yields for 30-year notes fell 0.049% to 2.056%. Low returns are usually bullish for non-yielding bullion because it reduces the chance of holding this asset class.

The US Dollar Index (DXY), which measures the greenback against a basket of other major currencies, fell 0.35% to 94.18, from an opening at 94.52. But the index is still up about 5% since the start of 2021. The double profit is beneficial for dollar-denominated commodities as it makes them cheaper to buy for foreign investors.

In other metals markets, copper futures rose to $4.458 a pound. Platinum futures rose to $1,024.90 an ounce. Palladium futures rose to $2,115.00 an ounce.

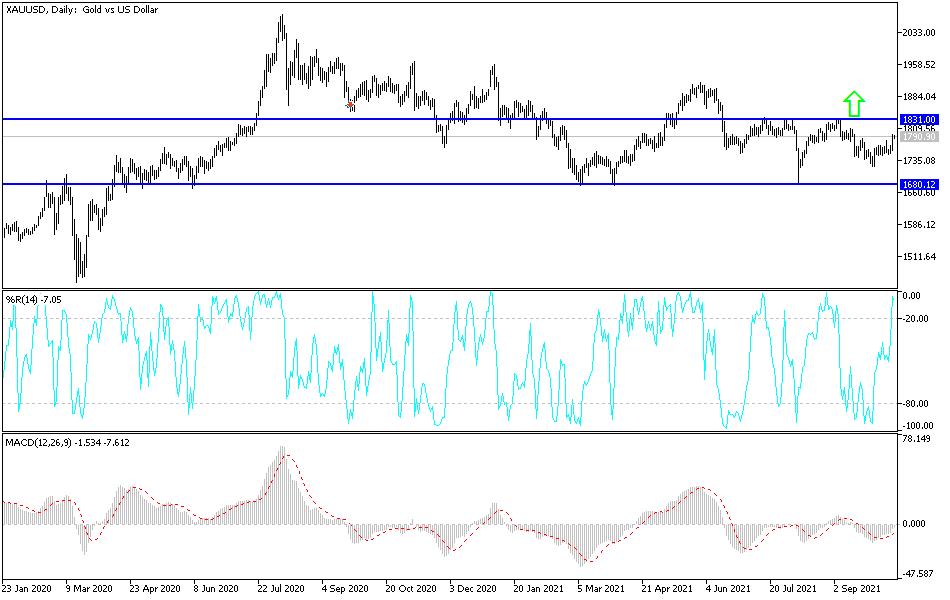

Technical analysis of gold

The current performance is on its way towards the psychological resistance of $1800, which was often noted as being of great importance for the bulls to control the performance for a longer period. If that happens, the next resistance levels for gold will be $1819, $1827 and $1845. Increasing global geopolitical tensions, stopping signs of tightening global central bank policy, and worrying about the return of COVID cases globally may motivate gold to go to that sooner.

On the downside, the support levels $1770, $1759 and $1740 will remain the most important for the bears to control the performance again.