Friday showed the gold's instability, as it jumped to the $1814 resistance level, then quickly collapsed to the $1783 support and started this week around $1800. Gold recorded its best weekly gain since August. The price of gold rose due to the weakness of the US dollar and the decline in Treasury yields. Gold prices gave up some of their gains on the back of the US Federal Reserve's hawkish tone. The question now is: Can gold resume its rise in the last trading weeks of 2021?

The gold price recorded a weekly gain of 1.6%, to reduce its decline since the beginning of the year to about 5.5%. The pace of gains has stalled, led by the global central banks’ trend towards tightening policy and raising interest rates to confront the hyperinflation that the global economy is facing in general due to the disruption of global supply chains and the rise in energy prices to their highest levels in years. Despite this, gold still received some support from the survival and impact of the epidemic, and fears that supply chain disruptions and the energy crisis will slow global economic growth.

As for the price of silver, the sister commodity of gold, it is trying to court the $25 level. Silver futures rose to $24.495 an ounce. The white metal posted a weekly gain of nearly 5%, trimming this year's 2021 decline to less than 8%. Metal commodities are booming on inflation fears, leaving investors fearing that the rising Consumer Price Index (CPI) and Producer Price Index (CPI) will squander purchasing power.

At the end of last week, US Federal Reserve Chairman Jerome Powell said that inflation may be higher than the central bank expected. At the same time, he indicated that it was time to reduce the institution's $120 billion per month asset purchases, but the dotted chart indicated that a rate hike could occur either by the end of 2022 or the end of 2023.

Gold prices had crossed $1800 before Powell's comments. Gold could accelerate or slow after the two-day FOMC policy meeting on November 2 and 3. Meanwhile, the metals market is benefiting from the weak dollar a little, as the US Dollar Index (DXY) fell to 93.73. The index also endured a weekly decline of 0.25%, but it is still up by more than 4.2% since the beginning of the year. The double profit is beneficial for dollar-denominated commodities because it makes them cheaper to buy for foreign investors. The US bond market had a mixed performance until it ended the trading week, and the yield on 10-year notes fell to 1.655%. One-year bond yields rose 0.012%, while 30-year yields fell to 2.086%. Yield losses are considered bullish momentum for gold because they reduce the opportunity cost of non-yielding bullion.

In other metals markets, copper futures fell to $4.4945 a pound. Platinum futures fell to $1047.40 an ounce. Palladium futures rose to $2028.00 an ounce.

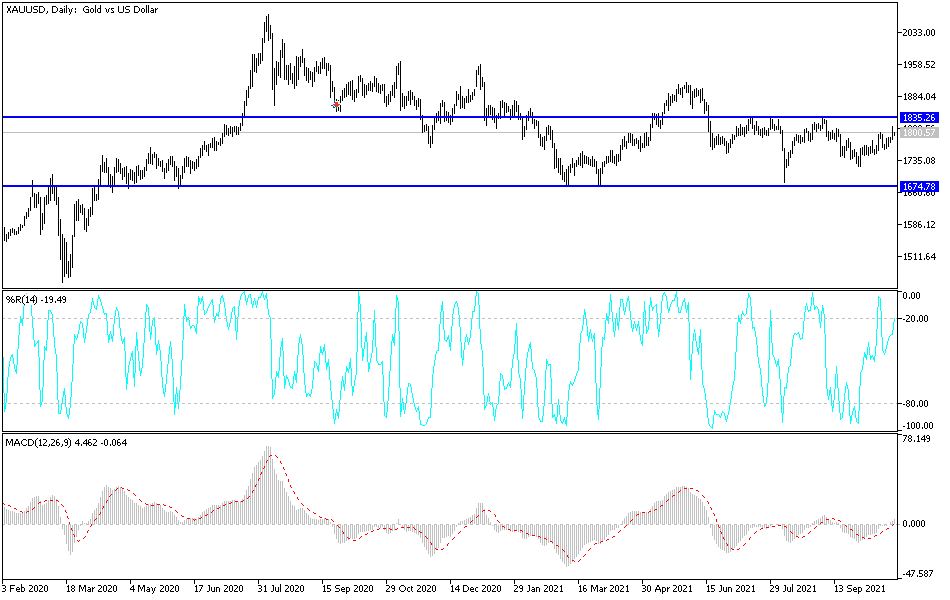

Technical analysis of gold

In the near term, and according to the performance on the hourly chart, it appears that the price of the yellow metal is trading within the formation of an ascending channel. As a result, the price of gold approached the overbought levels of the 14-hour RSI. Therefore, the bulls will look to ride the current bullish wave towards $1,787 or higher to $1,792. On the other hand, the bears will target short-term pullbacks around $1,778 or lower at $1,772.

In the long term, and according to the performance on the daily chart, it appears that the price of XAU/USD is trading within the formation of a sharp bullish channel. Gold has since advanced towards the 200-day moving average, which indicates a significant long-term bullish momentum. Therefore, the bears will target long-term pullbacks around $1,764 or lower at $1,744. On the other hand, the bulls will look to make profits at around $1,820 or higher at $1,845.