With the stability of the US dollar and the rise in US Treasury bond yields, the price of gold fell to the support level of $1783, as these factors led to curbing the demand for the yellow metal, which is considered a safe haven. Gold settled around the level of $1794 at the time of writing the analysis. Strong data on new home sales in the US and US consumer confidence lifted the dollar. Meanwhile, investors are looking forward to the upcoming monetary policy meetings of the European Central Bank (ECB), the Bank of Canada and the Bank of Japan. The European Central Bank is expected to take a docile stance when it meets on Thursday. The central bank meetings in Japan and Canada are also scheduled this week.

The US Federal Reserve will meet next week, and the US central bank is likely to announce plans to begin reducing its asset purchase program. The US dollar's gains come as investors increase bets, the Federal Reserve will begin to scale back its asset purchase program (to end quantitative easing) in November, laying the groundwork for a possible interest rate hike in 2022. The dollar has also benefited more broadly from the ongoing US economic recovery which outpaced the global recovery, while sporadic periods of sultry investor sentiment also pushed investors into the dollar.

The Fed is expected to announce by the market that it will reduce asset purchases on November 03 and provide guidance in line with a series of interest rate increases beginning in 2022. Other potential catalysts for a stronger dollar include the reappointment of Powell as chair of the FOMC, especially if that happens between now and November 5 or so as analysts see it.

A report from the Commerce Department showed that US new home sales rose significantly in September, rising 14% to an annual rate of 800,000 after declining 1.4% to a downwardly revised rate of 702 thousand in August. Economists expected new home sales to jump 2.7% to an annual rate of 760,000 from 740,000 originally reported for the previous month.

A separate report from the Conference Board showed that US consumer confidence reversed a three-month downtrend in October amid easing concerns about the delta variant of the coronavirus. The US Consumer Confidence Index reportedly rose to a reading of 113.8 in October from an upwardly revised reading of 109.8 in September. Economists had expected the consumer confidence index to fall to 109.0 from 109.3 originally reported for the previous month.

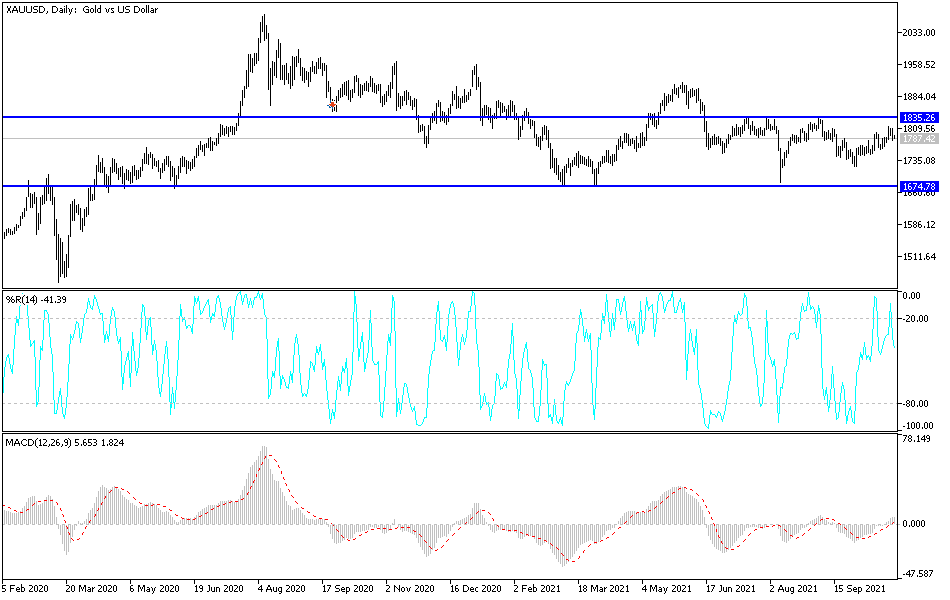

Technical Analysis

Despite the recent performance, the price of gold did not take the opportunity to correct upwards, but it is still the closest to breaching the psychological resistance of $1800. Stability above that resistance will increase buying to move towards the resistance levels of $1819, $1827 and $1845. These are important levels for an upward trend. I still prefer buying gold from every bullish level. Apart from the policies of global central banks, gold still has factors that support it in the long term.

The closest support levels for gold are currently $1775 and $1760. The US dollar will be affected today by the release of durable goods orders. And let's not forget that any surprises from the Bank of Canada today will have a strong and direct reaction to investor sentiment, and therefore gold.