At the beginning of this week’s trading, the price of gold recorded gains that reached the $1810 resistance. Gold is achieving weekly gains in an attempt to reduce its loss since the beginning of the year. The price of gold enjoyed a weekly rise of 2.2%, although it is still down more than 5% this year.

As for the price of silver, the sister commodity to gold, it is looking to top $25 an ounce this week for the first time since July. Silver futures rose to $24.52 an ounce. The price of the white metal rose by about 5% last week, reducing its decline since the beginning of the year to less than 8%.

Bullion is likely to benefit from gains in global financial markets. However, gold prices may cap a stronger US dollar with the US Dollar Index (DXY) rising to 93.80, and the DXY, which measures the performance of the US currency against a basket of other major currencies, is bad for dollar-denominated commodities as it increases their cost for foreign investors.

The US bond market was down across the board, with the benchmark 10-year bond yield dropping to 1.628%. One-year bond yields fell to 0.117%, while 30-year yields fell to 2.082%. A lower yield is also beneficial to the metals market because it reduces the opportunity cost of holding non-yielding bullion.

Commenting on the performance, Ricardo Evangelista, chief analyst at ActivTrades wrote, “The US dollar has been pulling back from annual highs hit earlier in October, as markets adjust to inflation concerns spreading across the globe, meaning the same forces that underpinned the US dollar earlier in the year is now pushing currencies to new heights, a dynamic that penalizes the dollar and thus supports gold.”

Gold may try to rally some gains ahead of the FOMC policy meeting next week. The Fed has signaled that it may start tapering its massive $120 billion per month quantitative easing program, although Chairman Jerome Powell said it was too early to raise rates.

In other metals markets, copper futures rose to $4,516. Platinum futures were traded at $1,053.10 an ounce. Palladium contracts rose to $2037.50 an ounce.

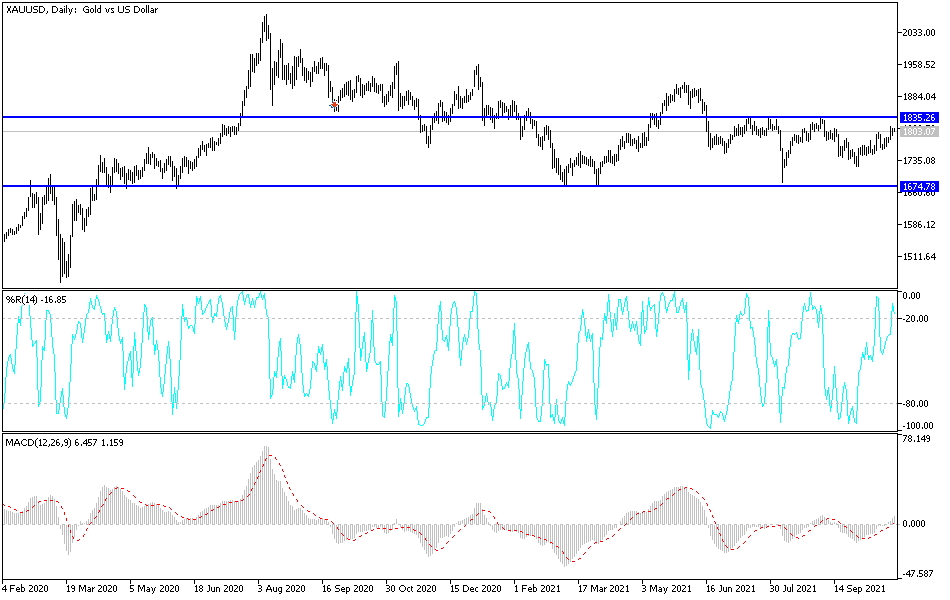

Technical analysis of gold

As I mentioned before, the stability of gold above the psychological resistance of $1800 will push the price upward to the resistance levels at $1819, $1827 and $1845, which will cement the bullish trend. The factors for gold's gains are valid, but the strength of the US dollar, with expectations of raising US interest rates, can halt gold's gains. On the downside, the support levels of $1776 and $1760 will remain crucial for the bears to control the trend, which is still bullish so far.