Despite the recovery of the US dollar, gold is stabilizing around the psychological resistance level of $1800 as of this writing. This confirms what we mentioned in recent technical analyses, which is that gold has many factors to achieve gains, but the strength of the dollar prevents this from happening. Yesterday, the limited dollar weakness and lower Treasury yields increased the demand for the yellow metal as a safe haven. In the same performance, silver futures closed at $24.191 an ounce, while copper futures settled at $4.3895 a pound.

In addition to absorbing the UK budget and the Bank of Canada policy announcement, traders are also looking forward to the upcoming monetary policy announcements from the Bank of Japan and the European Central Bank. Yesterday the Bank of Canada left interest rates unchanged but ended its quantitative easing program, indicating progress in the economic recovery. Meanwhile, British Chancellor Rishi Sunak announced that public spending will increase by 150 billion pounds in an attempt to support a strong economic recovery after the crisis caused by the pandemic.

The US Dollar Index (DXY) fell to 93.69 before regaining some of its gains. The yield on the 10-year US Treasury fell to about 1.565%, while the yield on the 30-year Treasury fell to 1.973%.

Data from the Commerce Department showed US durable goods orders fell much less than expected in September, falling 0.4% after jumping a downwardly revised 1.3% in August. Economists had expected durable goods orders to decline 1.1% compared to the sharp rise of 1.8% announced the previous month. Excluding a sharp drop in transportation equipment orders, durable goods orders rose 0.4% in September after rising 0.3% in August. The increase matched economists' estimates.

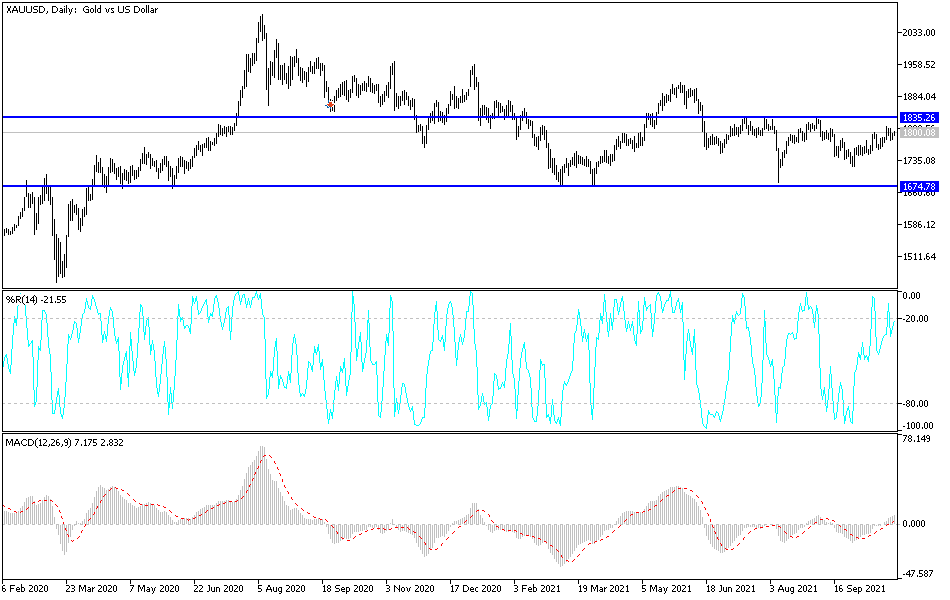

Technical Analysis

I still confirm that the stability of the gold price above the psychological resistance of $1800 will increase buying and push gold to stronger ascending levels, the closest of which are $1819, $1827 and $1845. On the other hand, these expectations may be threatened if the gold price moves to the support levels of $1775 and $1760. If this happens, it will be a new opportunity for buyers.

Gold will be affected today by the European Central Bank's announcement of its monetary policy decisions, the announcement of the US GDP growth rate and the number of weekly jobless claims.