Gold settled around the $1753 support level in yesterday's trading as it trades in a narrow range. The rise in US Treasury yields has pushed the dollar to a 3-year high against the Japanese yen. Yields on US 10-year Treasuries rose to more than 1.61%. The US Dollar Index, which measures the dollar's performance against a basket of six major competing currencies, rose to 94.30. Similar to gold, silver futures ended trading lower at $22.665 an ounce, while copper futures settled at $4.3665 a pound.

The focus this week is on US inflation and retail sales data. The Federal Reserve will release the minutes of its last meeting. Michael Saunders, policymaker at the Bank of England, said on Saturday that the inflationary rally "could become more constant unless monetary policy responds."

"I think it's appropriate that markets move into pricing a tightening path significantly earlier than they have been in the past," Saunders added. Earlier last week, Bank of England Governor Andrew Bailey warned that inflation exceeding the Bank of England's 2% target would damage the economy.

Commodities had a volatile week as market players assessed the supply-demand impact of the deepening energy crisis while cautiously awaiting the US jobs report and the reopening of Chinese markets. Gold's performance remained relatively neutral, as the Fed's outlook for monetary tightening kept pressure on prices, while mounting challenges to the global economy kept prices at a minimum. Industrial metals saw mixed trading reflecting stock markets amid a lack of signals from Chinese markets that were closed for the National Day holiday. Crude oil saw choppy trading but traded significantly higher near recent highs.

Concerns about the energy crisis have increased, with natural gas and coal prices rising sharply in Europe and Asia, raising fears of a winter supply shortage. The rise in gas and coal prices also increased the alternative demand for crude oil, which pushed it to new record levels.

While the energy crisis continues to weigh on market sentiment, market concerns have eased somewhat amid efforts to improve supply. Russia has indicated that it may boost its gas exports to Europe. China has also allowed some producers to increase coal production to manage the shortage. The US has also indicated that it may consider freeing crude oil stocks from emergency reserves to maintain prices.

The Fed is leaning towards monetary tightening and most Fed officials have confirmed that the criteria to start tightening monetary policy have been largely met. However, any decision may depend on the health of the US economy. Any sign of weakness or challenge for the US economy may be enough for the Fed to buy more time. The main test is the US non-farm payrolls report for September.

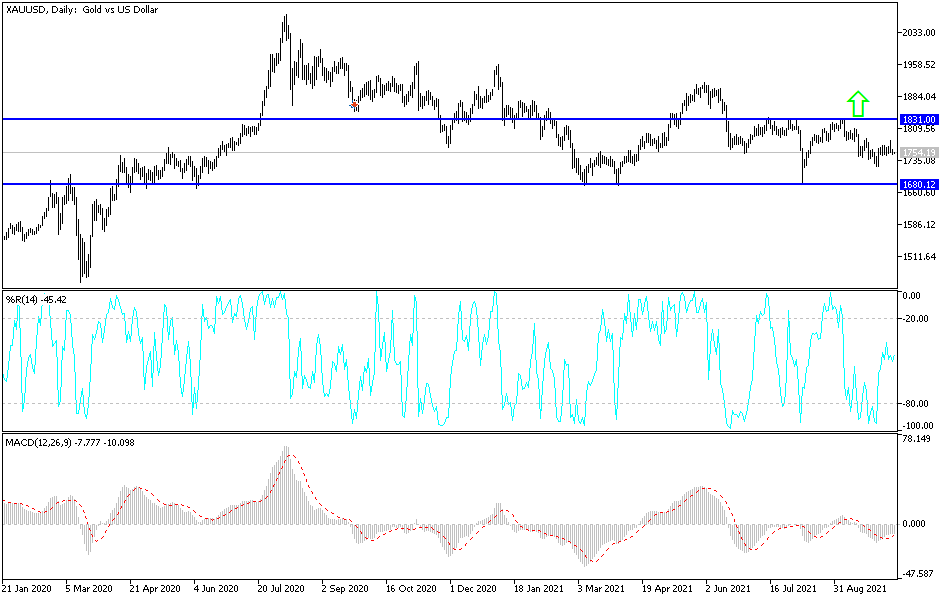

Gold technical analysis

On the daily chart, the price of gold returned to a neutral performance, waiting for a catalyst to move in one direction. Gold will be the closest to the downside if it moves towards the support levels of $1739 and $1720. On the upside, the $1800 psychological resistance will remain crucial for the bulls to continue controlling the trend.

The price of gold will be affected today by the strength of the dollar, risk appetite, and the reaction to the announcement of US inflation figures.