Gold futures settled slightly lower yesterday as riskier assets such as stocks rose amid easing concerns over the US debt limit and a larger-than-expected drop in US jobless claims last week. However, a slight weakening of the dollar limited the decline of gold. The price of gold is stable around the $1,760 level as of this writing. Today's US job numbers will determine the future of the current US dollar gains, and at the same time, the future of the gold price closure, which is still neutral with bullish bias.

The 10-year US Treasury yield rose to 1.563%.

On the other hand, Russian President Vladimir Putin's emphasis on increasing natural gas exports to Europe to solve the energy crisis raised sentiment in stock markets, which in turn reduced the demand for gold. Putin said that Russia is ready to stabilize global energy markets by sending more gas to Europe than it contracted this year.

Meanwhile, US lawmakers reached an agreement to temporarily extend the debt limit, avoiding a potential default. Senate Majority Leader Chuck Schumer (D-NY), announced an agreement to extend the debt ceiling through early December. The agreement is said to increase the debt limit by $480 billion, allowing the Treasury to continue paying its bills through December 3.

A report from the Labor Department said initial jobless claims in the US fell to 326,000, a decrease of 38,000 from the previous week's revised level of 364,000. Economists had expected jobless claims to fall to 348,000 from the 362,000 reported in the previous week. The release of the weekly jobless claims report comes a day before the closely watched monthly jobs report of the Labor Department is due on Friday.

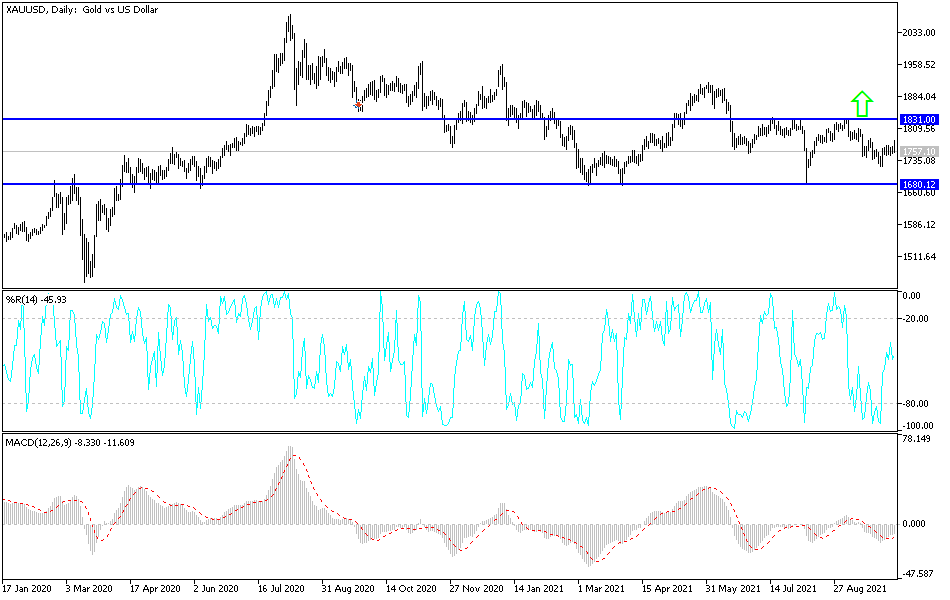

Technical analysis of gold

As I mentioned before, the price of gold will continue to move in narrow ranges until the US job numbers are announced today, which will have a strong and direct reaction to the stronger US dollar in the markets, and therefore to the price of gold, which is looking for catalysts to move strongly in one of the two directions. Bulls are hoping to break through the psychological resistance of $1800, and the bears are hoping for a return to the area of support at $1729. Whatever the results and reaction, I still prefer buying gold from every bearish level.

Today's US employment report includes the release of average hourly earnings, the rate of change in non-farm employment and the unemployment rate in the country. The results are important for expectations for the tightening of the Fed's policy.