Gold futures settled higher, but lacked the momentum to keep going and the price stopped at $1765 as of this writing. Gold's gain coincided with the bond yields dropping slightly. However, the gains were limited as the US dollar remained strong against most of its rivals, extending gains from the previous session. The dollar has gained on its safe-haven appeal with global stock markets plunging, as investors weigh economic growth expectations on the back of rising energy prices, major Chinese real estate debt crises, and the impasse in the US Congress over a debt market lift.

US Treasury Secretary Janet Yellen warned that the US could face a recession if Congress fails to raise the debt ceiling by October 18. Investors were also concerned that inflationary pressures may prompt global central banks to tighten policy sooner than expected.

In the same performance as gold, silver futures closed lower at $22.532 an ounce, while copper futures settled at $4.1475 a pound.

A report from the payroll processor ADP showed that private sector jobs in the US grew stronger than expected in September. The ADP said that US private sector employment jumped by 568,000 jobs in September after rising by 340,000 downwardly revised jobs in August. Economists had expected the US private sector employment rate to rise by 428,000 jobs, compared to an addition of 374 thousand jobs originally reported for the previous month.

Markets are now looking forward to the Labor Department's monthly employment report, which includes both public and private sector jobs. The data is due to be released on Friday. Economists now expect employment to increase by 488,000 jobs in September after rising by 235,000 jobs in August. The unemployment rate is expected to fall to 5.1% from 5.2%.

One of the main pillars of the strength of the US dollar in 2021 was the assumption that the Fed would start its exit from quantitative easing before the interest rate hike in 2022. The yield paid on US government bonds has soared as investors anticipate a combination of higher inflation and higher Fed rates, attracting interest from foreign investors hungry for positive returns and the offer of US security bonds. Also, the inflows of capital from foreign investors, in turn, led to the rise of the dollar, and this dynamic will continue to appear until other global central banks commit to raising interest rates.

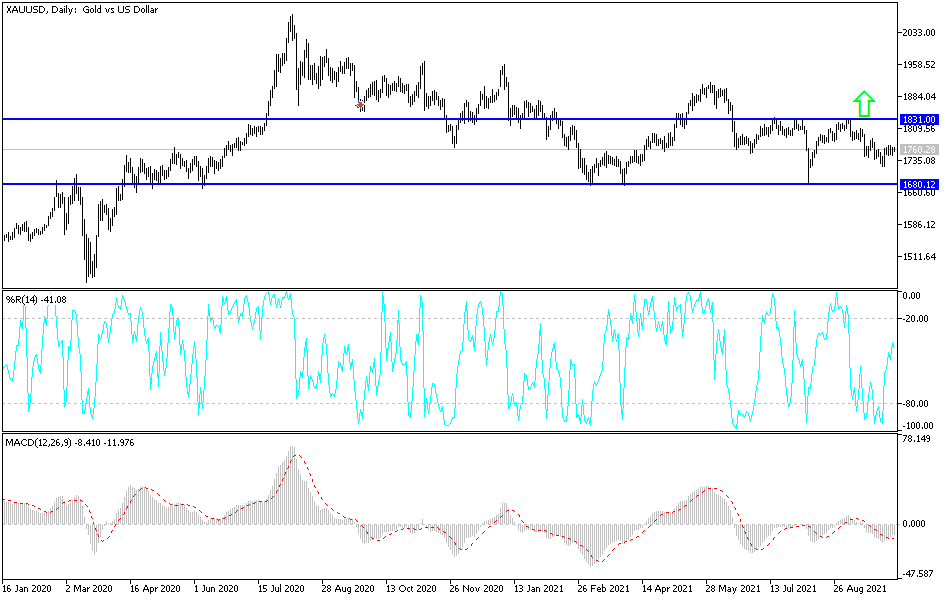

Technical analysis of gold

For four trading sessions in a row, the price of gold has been moving in narrow ranges, waiting for stronger stimuli to push it strongly in one of the two directions. The continuous strength of the US dollar is in favor of pushing gold downward, and the performance will become strongly bearish if the price of gold moves towards the support levels at $1749, $1738 and $1715. On the other hand, the complete change of trend in favor of the bulls will depend on penetrating the psychological resistance of $1800.

The price of gold today will be affected by the performance of the US dollar and the extent of risk appetite.