Gold has been particularly primed to compensate for its recent sharp losses, which pushed it towards the support level of $1722. Gold's rebound gains during the last three trading sessions brought it to the resistance level of $1770, where it has settled at the beginning of trading today. Breaking through the $1783 resistance will likely open for a move to the psychological resistance of $1800, especially before the announcement of the US jobs report, which is of interest to financial markets, to anticipate the course of the policy of the US Federal Reserve.

Currently, investors are increasingly concerned about inflation as oil prices rise and companies continue to face supply problems that increase their costs and force them to raise prices. Wall Street is also concerned about the timing of the Fed's curtailment of bond purchases and its eventual move to raise the benchmark interest rate.

Investors are also preparing for the latest round of corporate earnings, which will increase in the next several weeks. They also continue to monitor economic data closely for more indications about the pace of recovery as businesses and consumers continue to grapple with the impact of COVID-19 and the highly contagious delta variable.

A report from the Commerce Department showed that new orders for manufactured goods in the US jumped more than expected in August. Accordingly, the Commerce Department said that US factory orders rose 1.2% in August after jumping an upwardly revised 0.7% in July. Economists had expected factory orders to increase by 0.9%, compared to an increase of 0.4% from the previous month. The report showed that durable goods orders rose 1.8%, while orders for non-durable goods rose 0.6%.

Shares of troubled property developer China Evergrande Group and its property management unit Evergrande Property Services were suspended from trading in Hong Kong on Monday as investors await the next steps in the epic debt crisis. Evergrande Property Services said in its announcement to the Hong Kong Stock Exchange that trading of its shares has been suspended pending an announcement related to the merger or acquisition.

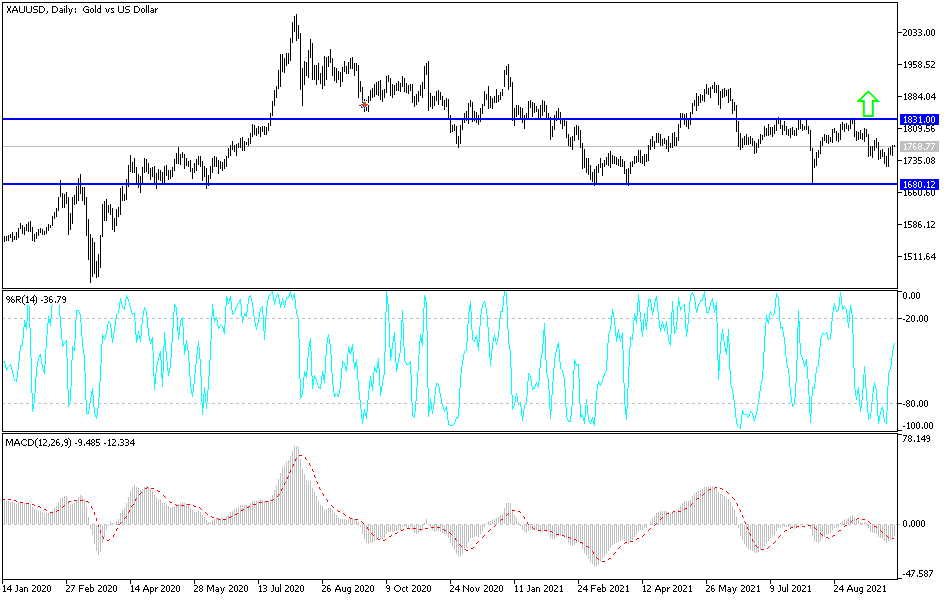

Technical analysis of gold

The formation of an ascending channel started on the chart today, and in order to continue, the price needs to move towards the psychological resistance of $1800, which would activate buying and complete the bullish path. On the downside, if the US jobs numbers come in this week stronger than expectations, expectations of tightening the Fed’s policy will increase. At that point, gold's gains will collapse quickly, and a move to the psychological support of $1700 dollars again is not ruled out.

So far I still prefer buying gold from every bearish level. Except for the Federal Reserve policy, there are many factors that may contribute to more investors' appetite for buying gold as a safe haven. The most prominent of them is the global energy crisis and its impact on the course of global economic recovery, the situation in China and the future of Evergrande’s bankruptcy, and that an event will increase fears of contagion and skirmishes between the two sides of the Brexit and the future of injuries and restrictions as a result of COVID.