Gold futures broke off a three-day winning streak and settled lower on Friday towards the $1,765 support, after touching the psychological top of $1,800 last session. The performance is being affected by the strength of stock markets and high bond yields. Yields remain supported amid expectations that the US Federal Reserve and other central banks will tighten monetary policy. The yield on the US 10-year Treasury rose to 1.573% in the session, although it was down from last Friday's close of more than 1.60%.

The US Dollar Index (DXY) rose to 94.07 and fell to 93.85 late Friday morning but later recovered. It was last seen at 93.98, slightly higher than the previous close. Nevertheless, gold futures rose about 0.6% in the past week, the best weekly returns in six weeks.

In the same performance, silver futures contracts closed lower at $23.349 an ounce. However, they did go up 2.8% in the past week. Copper futures settled at $4.7295 a pound, up 11% for the week.

Data from the Commerce Department showed US retail sales rose 0.7% in September after jumping an upwardly revised 0.9% in August. Economists had expected retail sales to fall 0.2% compared to the 0.7% increase originally recorded for the previous month. A report from the Labor Department showed US import prices rose 0.4% in September after declining 0.3% in August. Economists had expected import prices to rise 0.6%. A report from the University of Michigan showed the Consumer Confidence Index fell to 71.4 in October from 72.8 in September. The decline surprised economists who had expected the index to rise slightly to 73.1.

China's economic growth is under pressure from government regulations aimed at limiting energy use and reducing the financial risks arising from reliance on debt-fueled real estate developments. The manufacturing sector has also been hampered by a shortage of chips and other components due to the pandemic.

Compared to the previous quarter, and the way other major economies are measured, output in the July-September period barely grew, growing just 0.2%. That was down from 1.2% in the April-June period and one of the weakest quarters in the past decade. The annual growth pace of 4.9 percent was slightly below expectations and compared to the 7.9 percent growth in the April-June quarter, which exaggerated the slowdown in 2020.

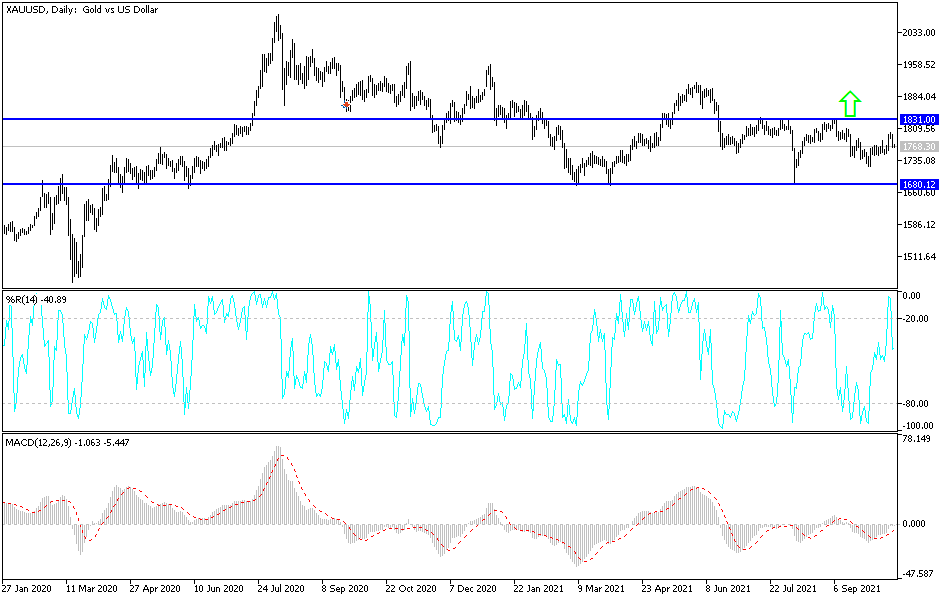

Technical analysis of gold

For the second day in a row, gold is stable around $1765, and according to the performance on the daily chart, it will return to its neutral environment between the support of $1747 and $1771, which was clear in the trading of the beginning of this month. A breakout in one of the two directions would confirm either a general trend to the upside towards the psychological peak of $1800, which it did for a very short time last Thursday, or a decline towards the $1710 support in the event that it falls below the support of $1747.

Nevertheless, I still prefer buying gold from every bearish level. The factors for its gains are still valid, but the strength of the US dollar is preventing it from taking full advantage of investors' demand for it as a safe haven.