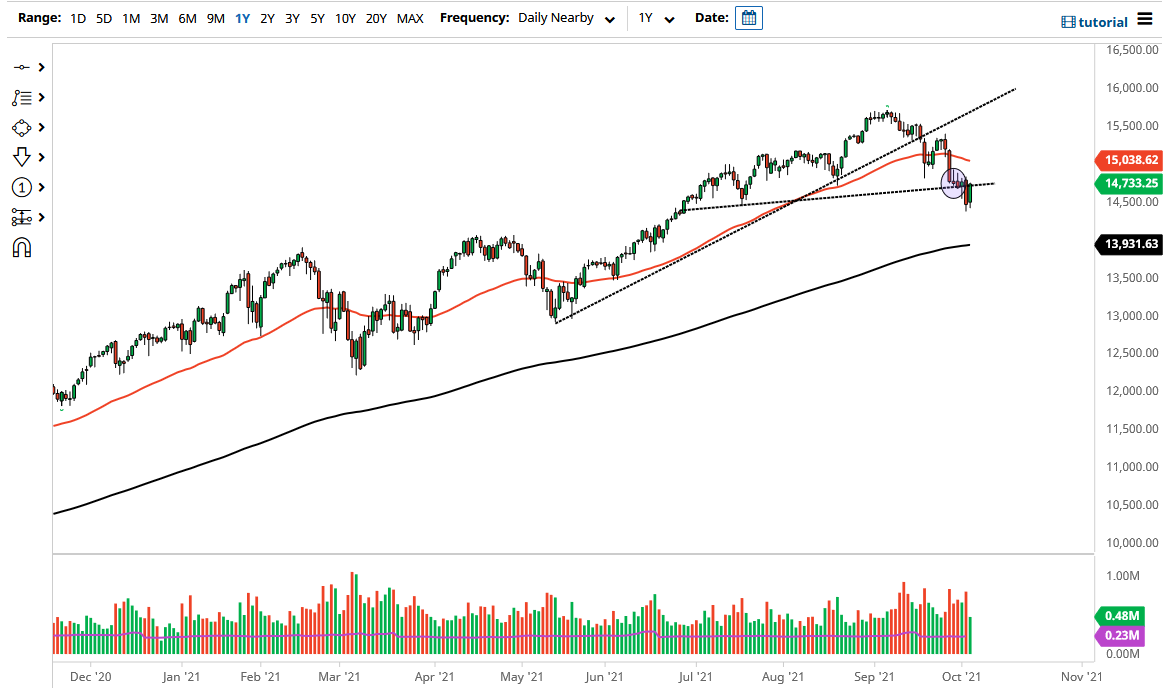

The NASDAQ 100 rallied significantly on Tuesday to wipe out most of the losses from Monday. At this point, we have a real conundrum, because we are hanging around the previous support line, but we also have seen a couple of inverted hammers sitting just above where we are right now, and I think it is likely that we continue to see trouble breaking out to the upside. I think it is much easier to buy this market if we break above the 15,000 level.

In order to break above the 15,000 level, we would have to see momentum pick up quite a bit in order to really get things going. Because of this, I anticipate that we will probably go back and forth between now and Friday, which is the non-farm payroll announcement. The 14,500 level looks to be offering support, so if we do pull back from here it is likely that we will go looking towards that level. If we break down below that level, then it is likely that we will go looking towards the 200-day EMA, which is sitting just below the 14,000 level.

In general, I think the one thing you can probably count on is a lot of chop between now and the end of the week, but I do not think we are going to see a massive move one way or another. However, if the US dollar suddenly takes off or breaks down, that could have a bit of an influence on where we go next. Nonetheless, this is a market that has been struggling for a while now, and if yields continue to strengthen, we may have more money flowing into the bond market than the so-called “growth stocks,” which of course makes up the majority of the actual index itself. Because of this, I think the market will continue to be very noisy and will have to focus on the bond market, just as we have for a while. On the other hand, if we have stability, then we will probably just go back and forth in a general “malaise” like we have over the last several days. Between now and Friday, I am not necessarily willing to get too big in any particular position.