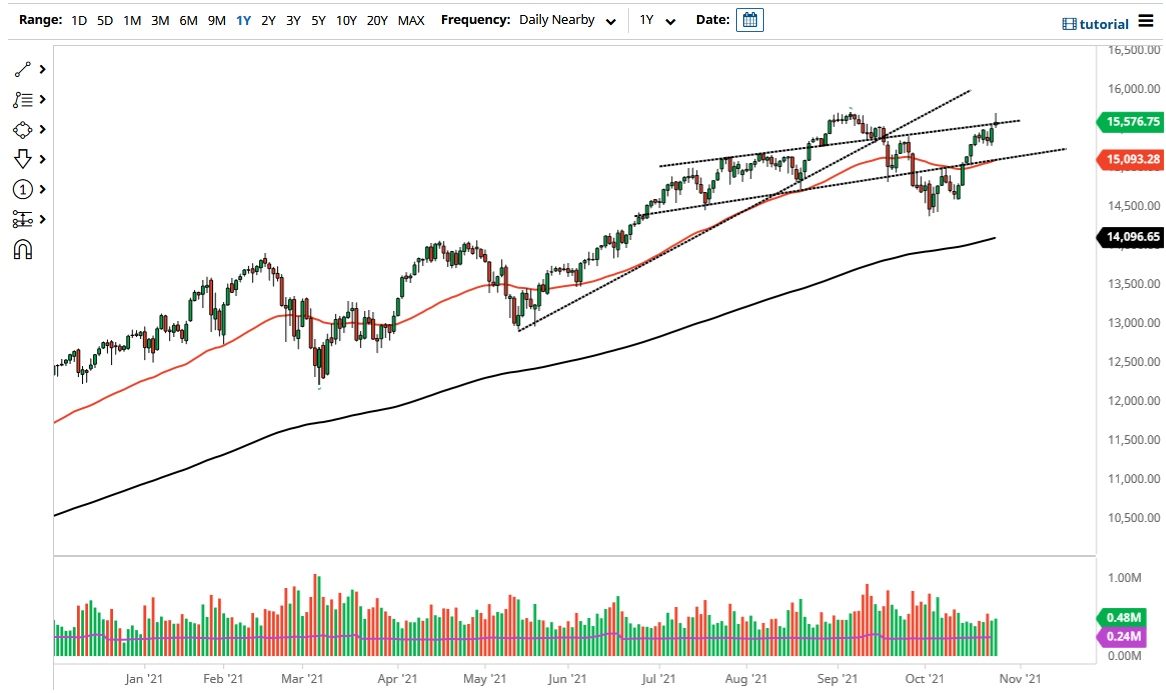

The NASDAQ 100 has rallied initially on Tuesday but gave back the gains as we reached towards the all-time highs. This is not a huge surprise, due to the fact that the market has shown itself to be a little overdone. Nonetheless, there is still plenty of volatility that will pick up around this area, as we continue bouncing around. If we break above the top of the shooting star for the session on Tuesday, then there will be new all-time highs and we can go much more to the upside.

The market has been very bullish for some time, and at this point in time it is simply looking as if it is ready to take a bit of a breather in order to build up the necessary momentum to go higher. The 50 day EMA currently sits just below the 15,100 level and is curling higher. That suggests that there should be plenty of buyers underneath, as we are not only likely to see a reaction to the 50 day EMA, but also the previous uptrend line. Nonetheless, the NASDAQ 100 continues to rally based upon just a handful of stocks, and as a result you have to follow Tesla, Netflix, and others like that.

The market will more than likely continue to see plenty of value hunters willing to come in and pick this market up, because quite frankly that is how markets behave in general, as central banks around the world continue to flood the financial markets with liquidity. With that being the case, I think we are looking at a scenario where you probably have a short-term opportunity to pick up buyers, but you certainly cannot short this market. After all, the markets have laid waste to those who would short them for the last 13 years, and therefore they cannot be looked at as a marketplace that reflects economic reality, rather a marketplace that measures liquidity. Liquidity is sloshing around in the markets, and as long as that is going to be the case it is impossible to short this market. That does not necessarily mean that you simply jump in with both feet and start building a huge position, you simply add as the market goes higher and, in your favor, in little bits and pieces.