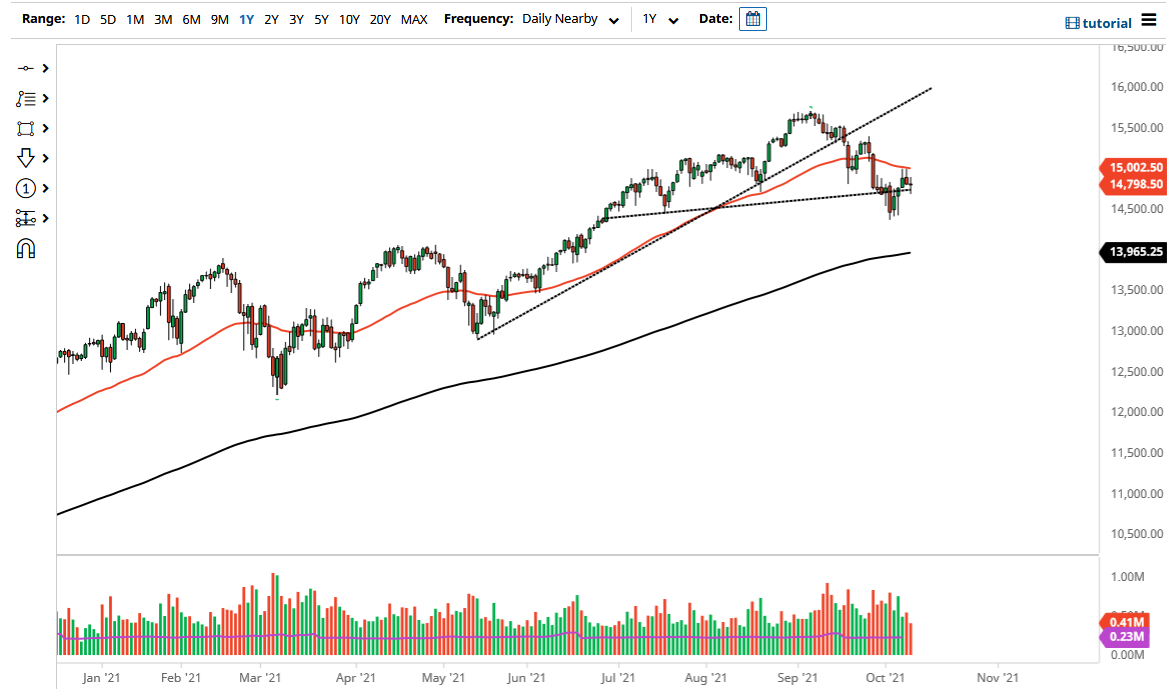

The NASDAQ 100 fluctuated on Monday as the previous support line continues to make quite a bit of noise. The neutral candlestick suggests that we have no idea where we are going in the short term, but I think there are a couple of levels and indicators that we need to pay attention to. After all, the neutral candlestick suggests that sooner or later we are going to see momentum pick up, but there are a couple things that I need to see tested first.

The 50-day EMA currently sits at the 15,000 level, so if we can break above there on a daily close, then I would be a buyer and would expect this market to look towards the 15,500 level. If we can break above there, then I think we can continue the longer-term trend to the upside. However, if we were to turn around and break down below the 14,500 level, then I would be a buyer of puts as we could go much lower, perhaps reaching down to the 200-day EMA, but I would have no interest whatsoever in trying to short this market because of the threat of “hopium” reaching into the market.

The candlestick that shows so much confusion for Monday suggests that we have no real clue in the short term, but longer term we have been bullish for what seems like ages. If the value of the dollar continues to strengthen, that could cause some issues in this market. That being said, I think that we are more or less focused on the idea of whether or not the markets are going to see growth in the global economy more than anything else, and it should also be noted that the NASDAQ 100 pays attention to just a handful of technology companies. Companies such as Tesla, Facebook, and Microsoft will continue to push this market in one direction or the other, but I still believe that you are looking for some type of pullback as an opportunity to pick up a little bit of value in a market that has been bullish for what seems like a lifetime. I am never going to short this market, but I have no problem stepping in and buying it once it shows signs of strength.