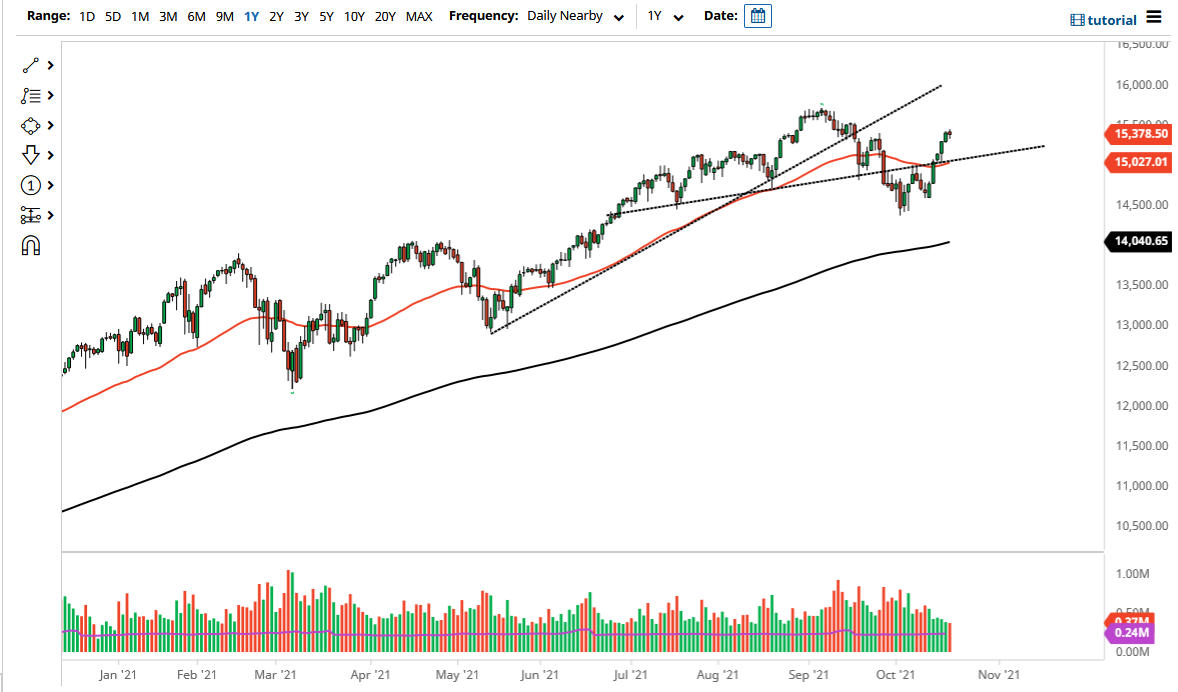

The NASDAQ 100 struggled on Wednesday as we continue to see a bullish move, but are trying to digest the most recent gains. If we can break above the 15,500 level, that opens up the NASDAQ 100 to a much bigger move, perhaps reaching towards the 16,000 level. Short-term pullbacks at this point in time should be buying opportunities, as we are most obviously in an uptrend. That being said, the market is going to continue to look at the 50-day EMA underneath as a potential support level, as well as the support line that sits right there also.

The NASDAQ 100 is moved by just a handful of stocks, not the least of which would be Facebook and Microsoft, but really this should be thought of as the NASDAQ seven, as it is only about seven stocks that make the biggest amount of weighting. That being said, these are all the darlings of Wall Street, but they also have another purpose: they are a way to take advantage of growth, especially in a low interest rate environment.

When you see this chart, you can make out a bit of a “W pattern”, but it is probably only a matter of time before people look at that potential double bottom as a floor. It is also worth noting that the pattern sits at the 14,500 level, so I do think that it is essentially going to be thought of as the “floor in the market.” The market will continue to see plenty of attitude when it comes to buyers, and I do think that we will eventually make a new all-time high. The liquidity measures will continue, despite the fact that the Federal Reserve may taper a bit.

If we were to break down below the 14,500 level, then the market could fall apart and go looking towards the 200-day EMA, perhaps even lower than that. The market is likely to continue to see selling pressure, but at that point I would only be a buyer of puts, and I certainly would not sell this market. You never short US indices because they are so highly manipulated by both Wall Street and the Federal Reserve.