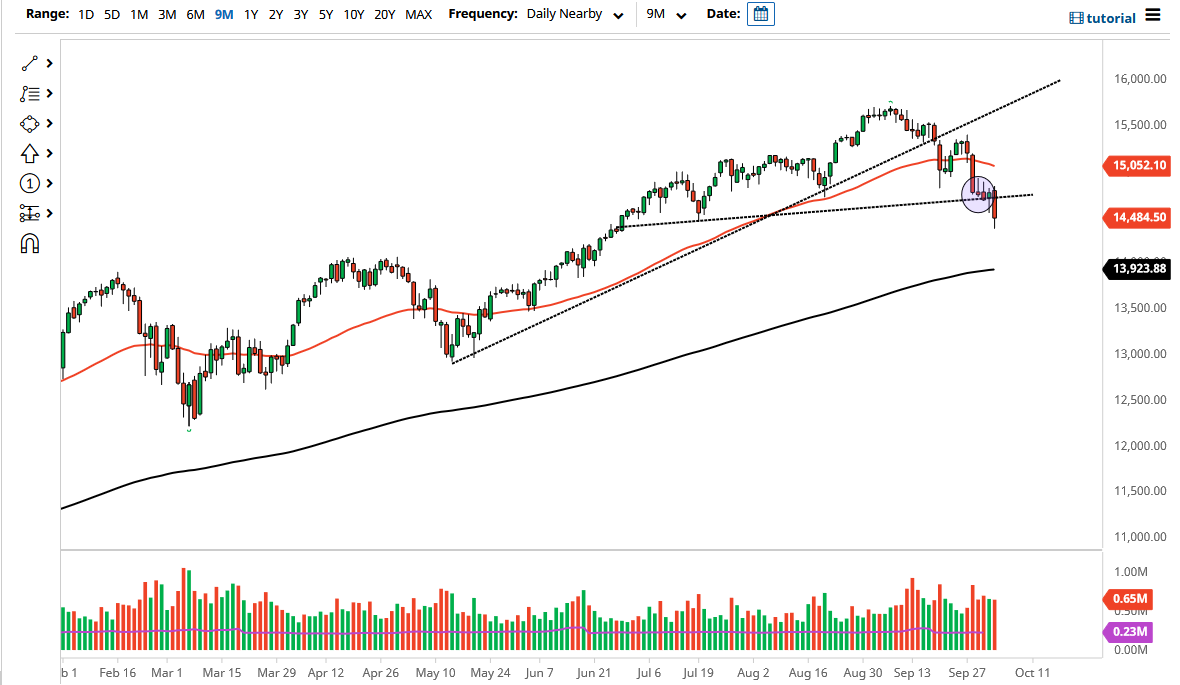

The NASDAQ 100 fell hard on Monday to show signs of extreme weakness. The hammer that formed on Friday has now been broken through, but perhaps even more importantly we have broken through the support line that the market has been paying so much attention to. We are just below the 14,500 level, and it is likely that we are going to continue to go looking towards lower pricing.

The 200-day EMA is sitting just below the 14,000 level, and right now I think that is probably the target. While the NASDAQ 100 looks very soft, the reality is that the market will eventually find some type of buying pressure, if for no other reason than the Federal Reserve will step in and save everybody on Wall Street. The market has desperately needed some type of pullback, and that is essentially what we are in the middle of right now.

The size of the candlestick is something worth paying attention to because it does suggest negativity. The market will more than likely continue to see downward pressure, but at the end of the day I think that you have to be cautious shorting this market. After all, with all of that manipulation, it is easier to simply be a buyer of puts as you can profit from the move to the downside. Your only real risk is going to be the premium you pay for the puts, instead of risking a significant hit to your account in the blink of an eye if you short.

If we were to break down below the 200-day EMA, I think we really could start to see the market fall apart. That being said, if we get to that point, it is likely that we will see a massive significant move. To the upside, if we were to take out the 50-day EMA, or at the very least the couple of inverted hammers from the previous sessions, then it is likely that I will get long of this market, due to the fact that the longer-term trend favors that anyways. Remember that it is just a handful of stocks that drive the NASDAQ 100, so as long as “growth stocks” come back into favor, this market should do fairly well.