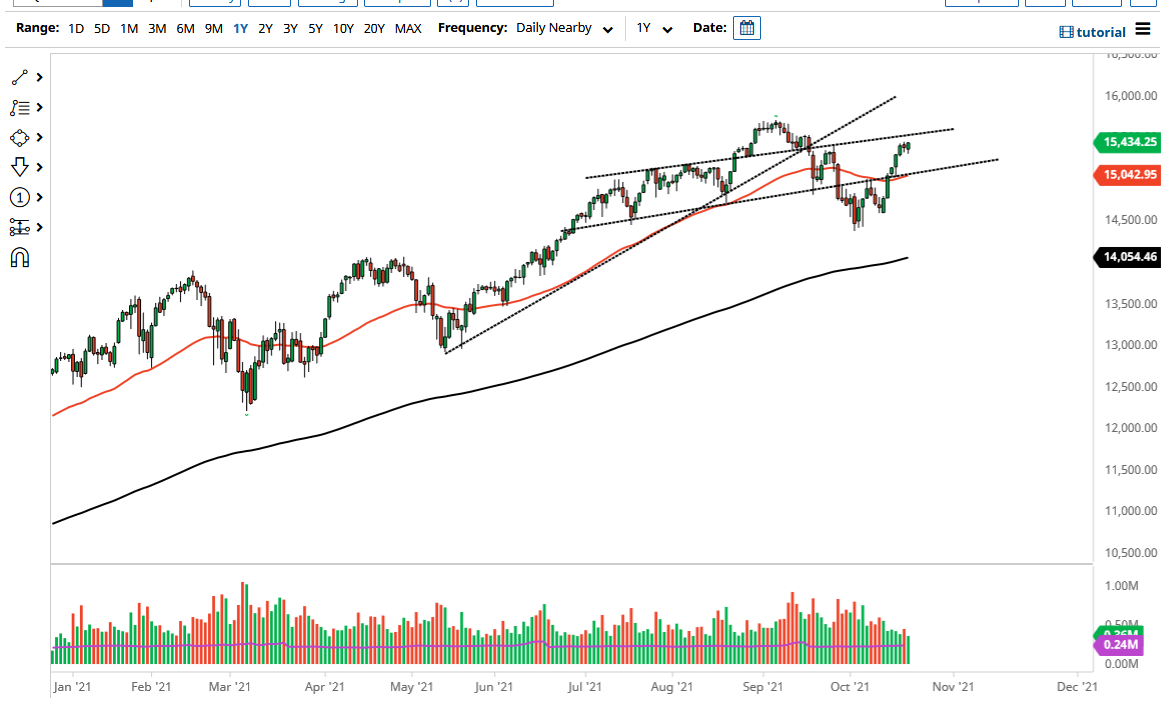

The NASDAQ 100 has gone back and forth during the course of the trading session on Thursday, showing signs of trying to build up momentum to go to the upside. That being said, the consolidation that we have had over the last couple of days is important, because quite frankly the market had gotten ahead of itself. With that being the case, the market is likely to see any pullback be bought into based upon the idea of value, especially with the 50 day EMA curling higher in tracing along the previous uptrend line. With this being said, the market is likely to continue seeing opportunities, lease based upon value.

To the upside, if the market were to break above the 15,500 level, then it is likely that we go looking towards the 16,000 handle. That is of course a psychologically important figure, but at this point in time I think it is only a figure that people will look at through the fact that it is a 1000 point increments. To the downside, the 14,500 level will offer support, as we formed a “W pattern” at that level. That is an area that a lot of people will pay close attention to, and therefore I think we continue to look at that as a “floor in the market.”

I have no interest in shorting this market, but if we were to break down below the 14,500 level, it is likely that I would be a buyer of puts in order to take advantage of a massive selloff. That could open up a move down to the 200 day EMA, but I find that it would be very unlikely to happen anytime soon. This is especially true considering that we are in the midst of earnings season, and quite frankly earnings season seems to be very bullish this quarter, and quite frankly any excuse whatsoever to buy the stock market as being used. The liquidity measures continue to push everything higher, and therefore the NASDAQ 100 will almost certainly be no different. With that, look for value and then take advantage of it. The NASDAQ 100 of course is pushed by just a few stocks, so all of the usual suspects should be followed such as Facebook, Microsoft, and Tesla. If those go higher, this index will just due to the weighting of those few companies.