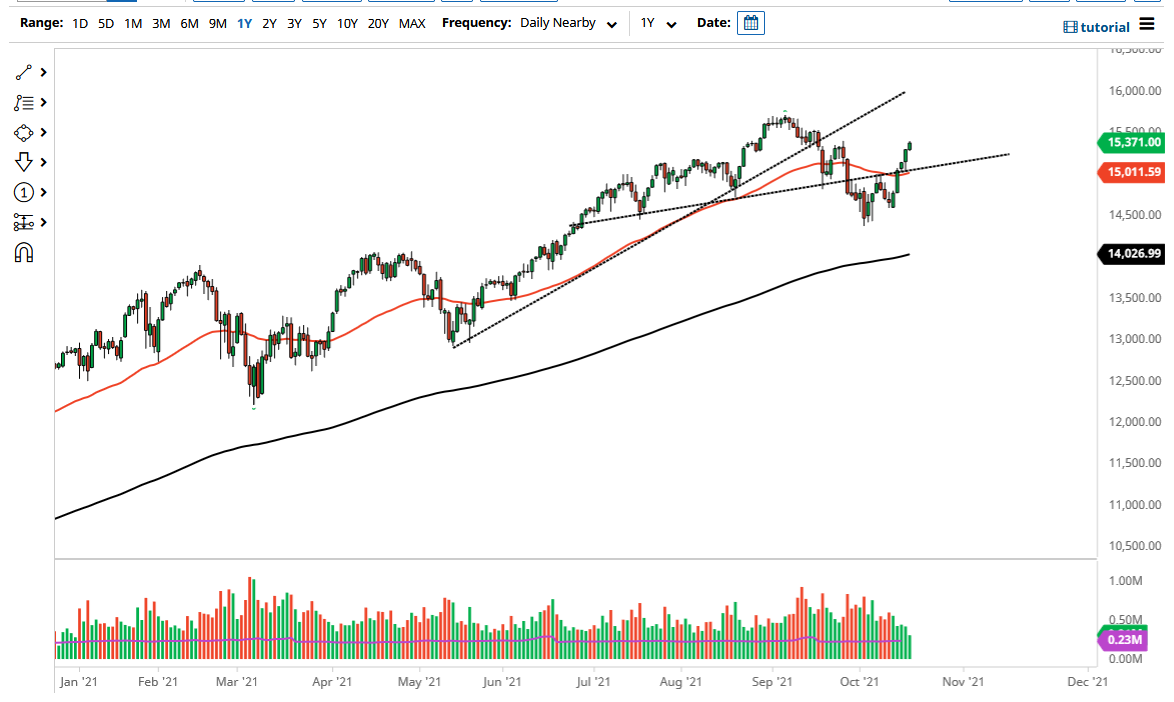

The NASDAQ 100 rallied a bit on Tuesday for the fifth candlestick in a row to print green. At this point, the market is a little overdone, but at the end of the day this shows just how much bullish pressure there is overall, and I think any significant pullback at this point in time will probably be an opportunity to get long.

Looking at this chart, it is easy to see that the 50-day EMA hugging the uptrend line makes sense for support. I think it is also worth noting that it is sitting right at the 15,000 level, so it all ties together quite nicely. With this, I think that short-term pullbacks will continue to be thought of as buying opportunities, and I would love to see a day or two of negativity come into the picture, as it could give us a little bit of value from which to trade. Be that as it may, it is also worth noting that the market is in the midst of earnings season, so that will have a certain amount of influence as well. I think this is a scenario in which we continue to see plenty of volatility, but as we have just broken the back of an inverted head and shoulders, or at the very least a couple of fractals and a “W pattern”, it makes sense that we would get involved.

If we were to break down below the 14,500 level, then it is possible we could go looking towards the 14,000 level, but that seems to be the least likely of scenarios. If we break down below 14,500 underneath, then I would be a buyer of puts, but that is as negative as I get when it comes to US indices. I think it is much more likely that we are going to reach towards 16,000 than 14,000 in the near term, so that is how I am playing this market, picking up little bits and pieces of value every time it dips. With the central bank doing everything it can to keep the markets afloat, it is almost impossible to fight the type of momentum we see in the marketplace overall.