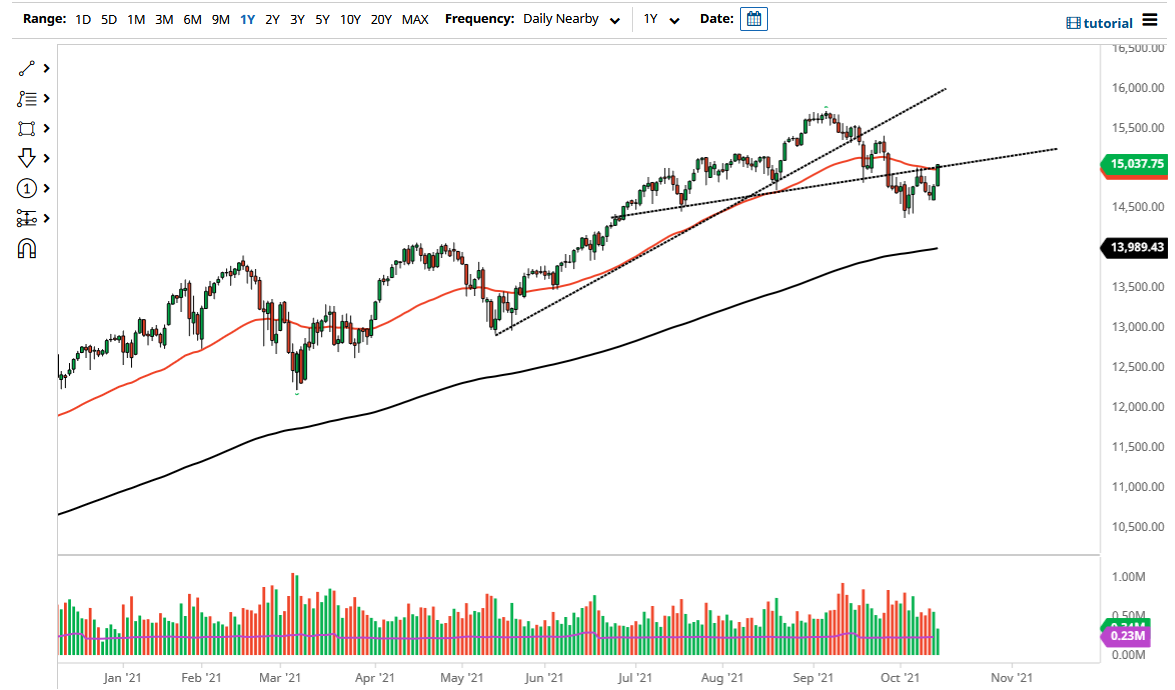

The NASDAQ 100 has rallied quite significantly during the trading session on Thursday to show signs of life again. Quite frankly, the market is going to continue to go higher from here unless something changes quite drastically. After all, the market is closing towards the top of the range, and of course has just broken above the 50 day EMA, which is a bullish sign as well. With that being said, think it is only a matter of time before momentum picks up even further, and perhaps since the NASDAQ 100 towards the 15,500 level. Climbing above the 15,000 level would be a bullish sign as well.

At this point in time, it is worth noting that we have cleared the most recent high, so now we have made a confirmed “higher low” and are working on breaking out of a W pattern as well. In other words, everything on this chart looks bullish all the sudden, and it is also worth noting that the NASDAQ volatility has fallen through the floor, so all things been equal, I am bullish of this market as we have gotten through the first 24 hours of earnings season.

I believe that short-term pullbacks will continue to be thought of as buying opportunities in a market that has been strong for quite some time. Yes, we have been noisy as of late, but when you look at the total picture, we are still very much in an uptrend. The 200 day EMA is sitting just below the 14,000 level and is rising, so I do think that we will continue to see plenty of buyers jumping into this market and push it higher over the longer term. The 16,000 level above is your target in the next several months, and of course will attract a lot of attention itself as it is a fresh, new, all-time high.

I could be a buyer of puts if we break down below the 14,000 level, but quite frankly I just do not see that happening anytime soon, but as you know I will not short US indices as they are so highly manipulated by the Federal Reserve via jawboning and of course quantitative easing. Because of this, I believe that any dip that you see in the short term will more than likely end up being a nice opportunity to get long yet again.