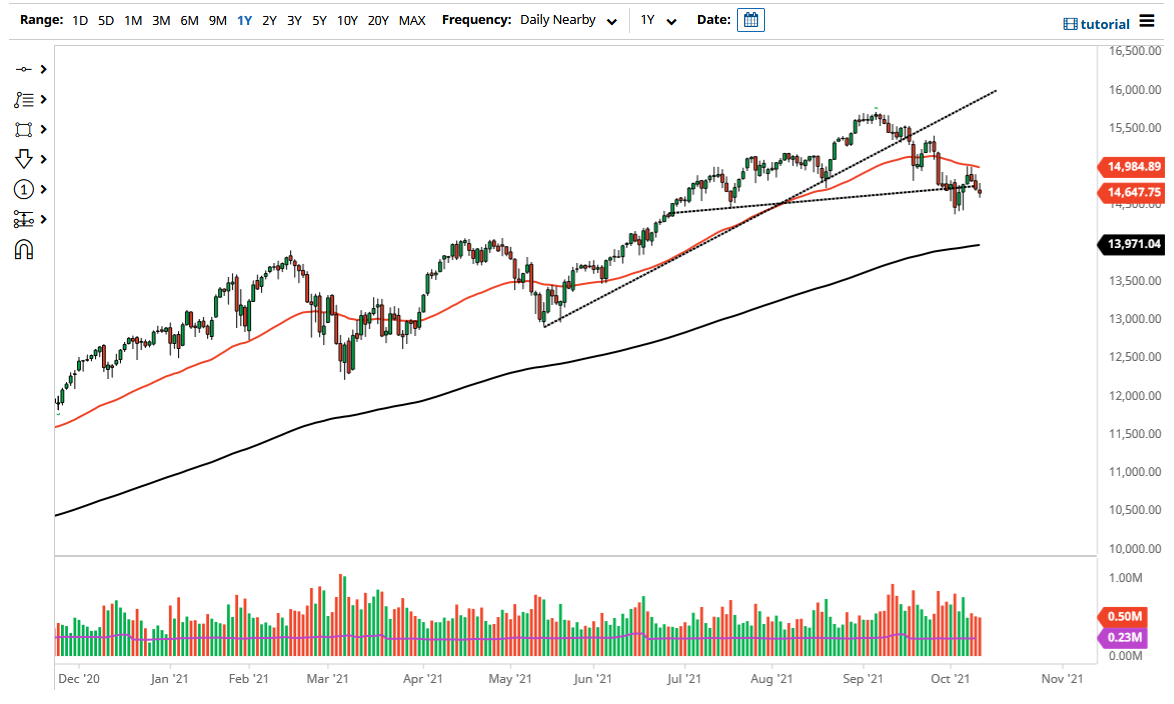

The NASDAQ 100 was trying to rally on Tuesday but continues to slump as the markets are starting to be concerned about inflation and other such situations globally. The market ended up forming a bit of a shooting star, and I think it is only a matter of time before we go looking towards the 14,500 level. That is an area that has been supportive previously, and it is an area that I would be paying close attention to. If we break down below there, then it is likely that I would be a buyer of puts, as I believe the market will go looking towards the 200-day EMA.

On the other hand, if we were to break above the top of the candlestick for the trading session, then we will go looking towards the 50-day EMA above, which is starting to drop lower. The 15,000 level sits just above there, so I think that is what we need to see broken above in order to get long. On that move, then I believe that the market will go looking towards the 15,500 level, even the 15,750 level, where we have recently seen the all-time high.

I do think that we will see a lot of choppy volatility more than anything else, so it is not overly surprising that you should be cautious with your position size, because if you get overzealous at this point, it is likely that you would see a lot of choppiness that could do real damage to your account. I am much more comfortable going long in this market, so I would love to see a move above the 15,000 level that I could get aggressive with, but I would also need to see how the daily candlestick forms and closes, because that will also have a lot to do with whether or not there is momentum going into the close, which is something that I always pay particular interest to. At this point, I am simply waiting for an opportunity to get long, but like I stated multiple times, I do believe that you can be a buyer of puts in order to express a negative point of view, but shorting is almost impossible due to the overzealous manipulation by the Federal Reserve of equity markets.