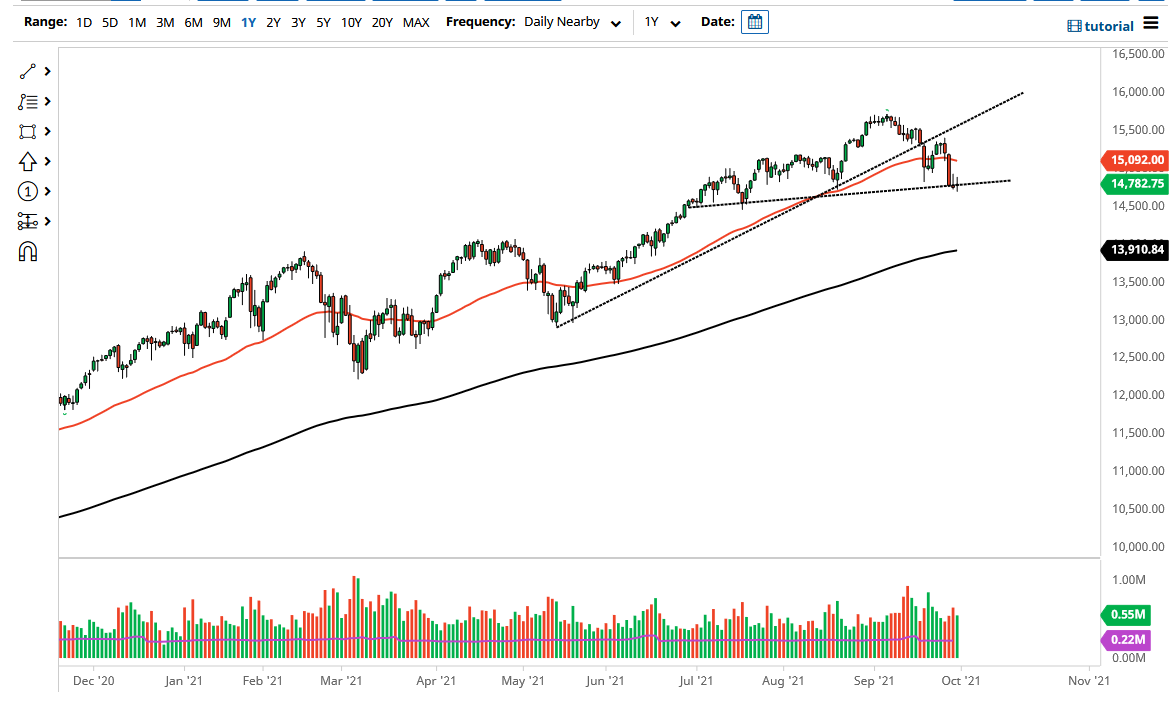

The NASDAQ 100 has tried to rally during the trading session on Thursday but gave back the gains to show weakness yet again. This is interesting, considering that we are extraordinarily weak looking, but yet at the end of the day the market simply cannot get off of its floor. The stock markets continue to be manipulated via speeches on Capitol Hill, and of course the central bank, so yet to be very cautious about trying to short anything. If we break down below the last couple of days, I might be a buyer of puts, but that says bearish as I get as you know.

On the other hand, if we can break above the highs of both Wednesday and Thursday, it is likely that the market goes to save itself towards the 50 day EMA. That in general is the standard playbook for stock markets in America, and at this point in time one would have to think that it is only a matter of time before that happens. Because of this, I look at any significant break down is a short-term put buying opportunity more than anything else, only to turn around and buy this market on signs of support. Quite frankly, the games been going on for at least 13 years that I know of, which states almost explicitly that the stock markets cannot lose more than about 10% before the Federal Reserve comes in and save everyone. Recently, we have seen the veil pulled back, with the Federal Reserve caught having several of its governors profiting from this move. That will continue to be the norm one way or another.

Because of this, I think that a breakdown gives your short-term opportunity but as far as shorting the market is concerned, it is like picking up pennies in front of a steamroller. Indices are meant to go higher, that is why they are not equally weighted. In other words, it only takes a handful of companies to turn this market back around, so that is what you get. A break above the 50 day EMA allows the market to go looking towards the highs again, but I think we probably have a little further to go and the pullback in order to find an of value to attract more buyers.