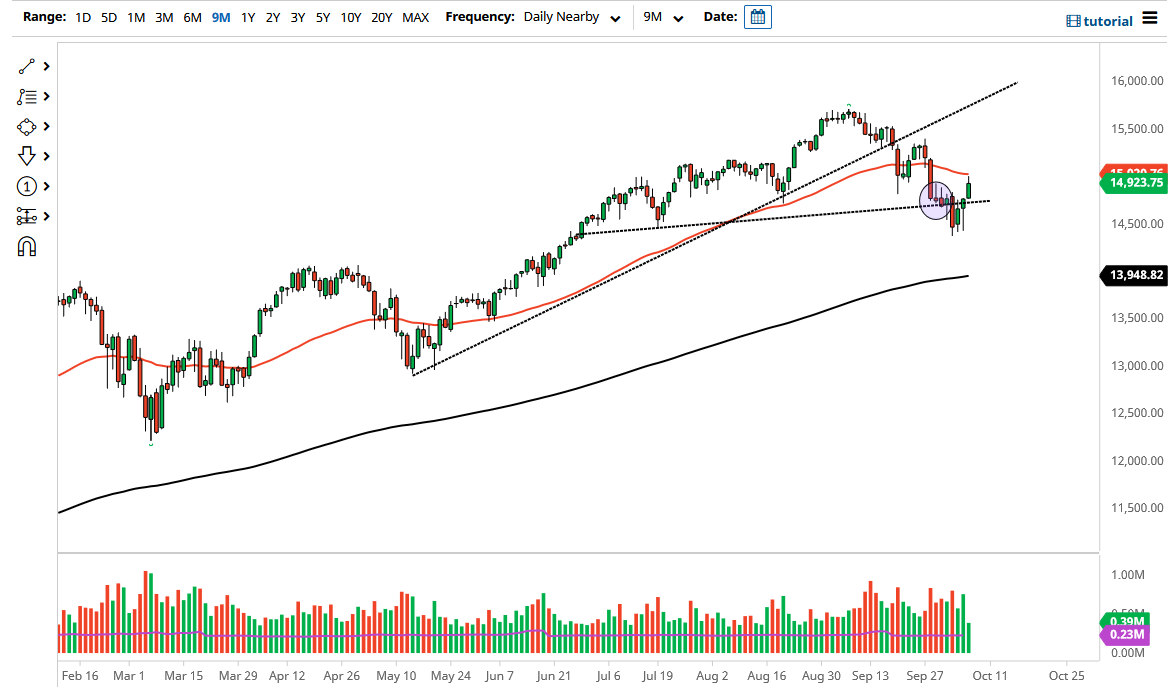

The NASDAQ 100 has broken above the top of the previous trendline that I have marked on the chart. This is a market that continues to see a lot of noisy behavior, and the fact that we turned around and broke above the top of the hammers from the trading session suggests that we are going to continue to see a bit of a move to the upside, but we also have the jobs number on Friday to pay close attention to. In other words, we need to keep in mind that the momentum can shift rather rapidly, and it is worth noting that the 50 day EMA seems to have put a bit of a lid on the market.

Once we get through the Friday session, we might have the ability to see a bit of clarity in a market that has lacked it as of late. If we can close above the 50 day EMA, that would obviously be a very bullish sign and could send the NASDAQ 100 higher. On the other hand, if we turn around and fall through the 14,500 level, that would be an extraordinarily negative sign and could send the NASDAQ 100 much lower. Nonetheless, we all know that Wall Street eventually find some type of narrative to go higher, so as a general rule I simply do not short these indices.

If we were to break down below all of those lows from earlier this week, I would be a buyer of puts and wait for the market to hit the 200 day EMA. The 200 day EMA of course is a major indicator that a lot of people will be paying close attention to, so with that in mind it is likely that is the destination if we continue to see negativity.

This marks a potential turnaround, so if we do break above the 50 day EMA it is very likely that we go looking towards the highs over the longer term. There is a little bit of a downtrend line that you can imagine offering a little bit of resistance, but at the end of the day I think that short-term trouble more than anything else. The market is most certainly starting to turn around and show signs of life again, so I think that is something that you need to be cognizant of.