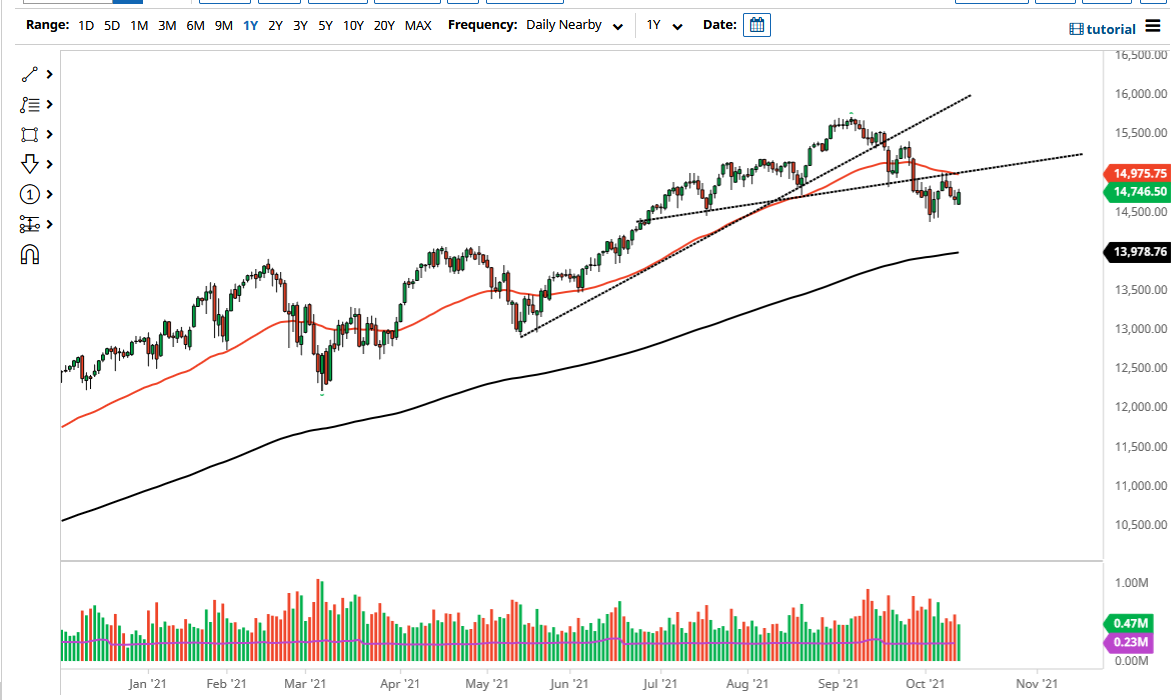

The NASDAQ 100 rallied significantly on Wednesday to reach towards the 14,750 level, which is a bullish sign. That being said, the market is looking strong at the end of the day, as we have closed towards the top of the range. That is normally a sign that we are going to continue to go higher, as it shows real continuation possibilities and conviction.

The 50-day EMA has recently offered resistance at a couple of shooting stars and is sloping lower. This is a very negative barrier, but if we can get above there then the market is likely to go much higher. That being said, I think if we can break above the 50-day EMA and perhaps even the 15,000 level, then it is time to go long, perhaps aiming for the 15,300 level rather quickly. The NASDAQ 100 will be dealing with the volatility of the earnings season, so keep in mind that we will see quite a bit of choppy behavior.

If we turn around and break down below the bottom of the candlestick for the trading session on Wednesday, then it is possible that we could go looking towards the 14,400 level as well. That is an area where we bounced from previously and could constitute a bit of a “floor in the market.” Breaking down below that level then opens up the possibility of buying puts, as we are going to go looking towards the 200-day EMA which is sitting just below the 14,000 level. Breaking down below that would of course be a very negative turn of events, but I still have no interest whatsoever in trying to short this market flat out.

A break above the 50-day EMA would have me getting aggressively bullish, because it would be the same type of attitude that we have had for ages and it also clears that previous trendline that we have already tested once. The NASDAQ 100 is pushed around by just a handful of companies, so make sure you pay close attention to Facebook, Alphabet, Tesla, and all of the usual suspects as they are the biggest part of this market overall. You never short the NASDAQ 100 or any other US index for that matter, so keep that in mind.