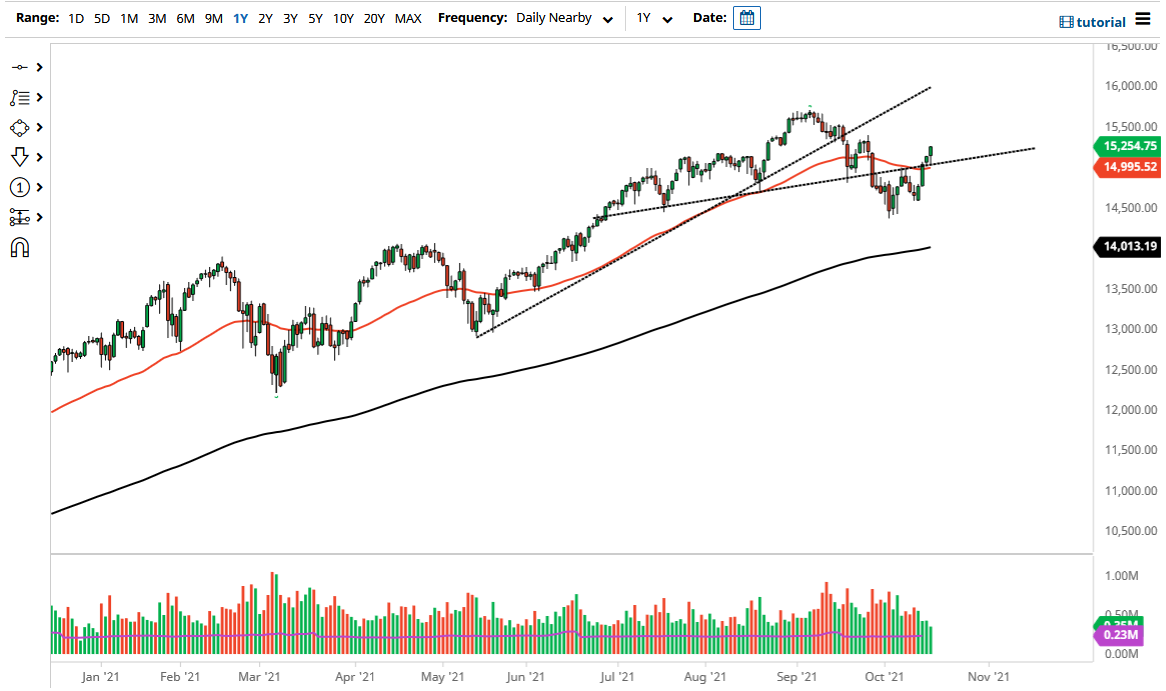

The NASDAQ 100 initially pulled back on Monday but found enough support at the 50-day EMA to turn around and jump. The market closing towards the top of the range is very positive, but it certainly looks as if there is plenty of momentum overall, and I do think that it is probably only a matter of time before we clear the 15,500 level. Clearing that level could open up a move to break the recent highs and continue going even further. The NASDAQ 100 is very bullish due to the fact that just a handful of stocks tends to push it to the upside, so you need to pay attention to the usual names such as Tesla, Facebook, and Microsoft.

When you look at this chart, it looks very likely that we would see a continuation for the market to go higher, and I think what we are seeing here is the NASDAQ 100 simply recovering from a recent pullback. Although it has been somewhat negative, the reality is that the market just pulled back a few percentage points from the all-time highs, and despite the fact that there is a narrative of doom and gloom out there, the reality is that this was a simple pullback. As we are now in the midst of earnings season, it does make sense that we will see some choppy behavior.

It is not until we break down below the 14,400 level that I would consider doing something negative in this market, which in this case would be buying puts as the market is almost impossible to short, due to the fact that the Federal Reserve will step in and jawbone the thing back up either through comments in the news, or the latest statement. After that, they also can get into the bond market, but it is going to be a bit down the road before that happens. This is a market that has just kicked off a major “W pattern, or you could even make an argument that we have just broken out to the upside from the “inverted head and shoulders” that you can also draw. Either way, the downtrend line will be broken, and that in and of itself could attract a certain amount of attention.