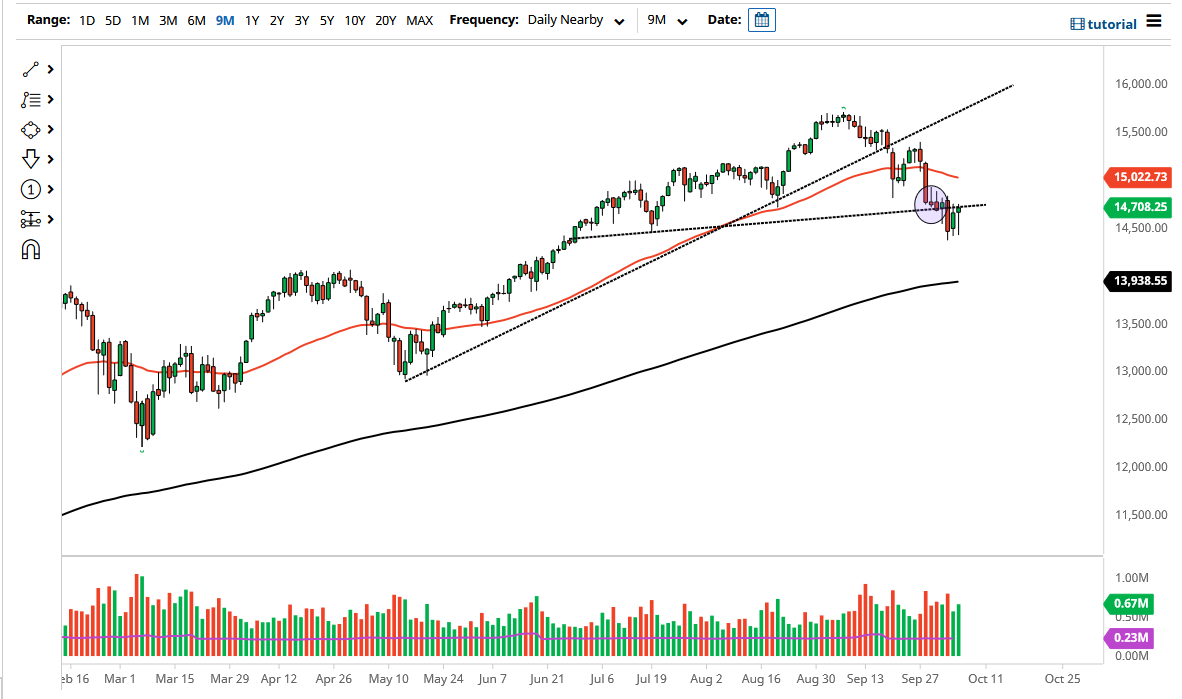

The NASDAQ 100 fell rather significantly on Wednesday as we continue to hear a lot of noise when it comes to the stock markets in the United States. That being said, the market still has plenty of support just below, especially near the 14,500 level. The fact that the jobs number comes out on Friday will probably keep this market somewhat quiet, but more likely than not we will find buyers based upon value and the fact that Wall Street has been trained over the last 13 years to buy every dip.

When you look at the area where we are closing, we have seen a support level hanging in that general vicinity, so it will be interesting to hear a lot of noise around this area. The area that I have circled on the chart features a couple of inverted hammers followed by a hammer that has been broken to the downside. This shows just how much noise there is in this vicinity, which is an area that should be paid close attention to.

Keep in mind that the jobs number comes out on Friday so I do not necessarily think that we are going to see a massive move between here and there, but if we were to break above the top of those couple of inverted hammers that I have circled, that could open up a move to the 50-day EMA and beyond. At that point, it is likely that we would continue the overall uptrend that this market has been in most of the last 13 years.

To the downside, if we break down below the 14,400 area, it is likely that the market could drop towards the 200-day EMA which is sitting just under the 14,000 level. That is an area that I think the longer-term traders will be paying close attention to, and they will be looking to pick up a bit of value there as well. That being said, I have no interest in shorting this market, so at the very most I would consider buying puts. You simply do not short US indices; they are not engineered to go lower anytime soon and the Federal Reserve will step into the market either via jawboning or quantitative easing.