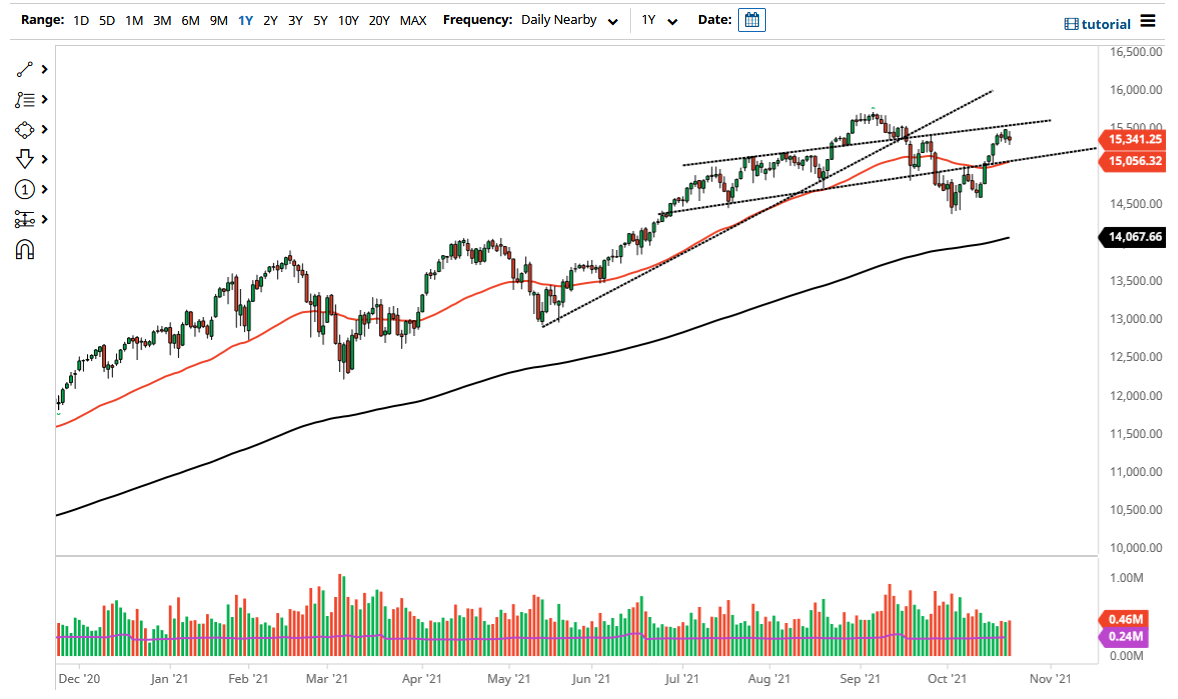

The NASDAQ 100 fluctuated on Friday as we continue to hang around just below the 15,400 level. This is a market that has been going sideways for the last couple of sessions, so it is not a huge surprise to see that we saw more of the same on Friday as traders w home for the weekend. I think this is a market that will eventually find buyers on dips, but at this point we may have gotten a little ahead of ourselves.

That being said, the market is likely to see plenty of buyers underneath, due to the fact that it has been so strong. The 50-day EMA is sitting above the 15,000 level, which is sitting just on top of the previous uptrend line. I think at this point it is very likely that we will see a lot of volatility and a small pullback, but that small pullback probably does not mean much in the end of the day, as the market will probably continue to see plenty of value hunters.

As we get through earnings season, is very likely that we will continue to see good news to push markets higher, but a lot of this sluggishness could be written off due to interest rates in the United States rising. After all, these “growth companies” that tend to make up the biggest part of this index will move in a low interest-rate environment. They are much more attractive than fixed income when there is almost no yield to be had. Traders will go into the growth stocks in order to make up the difference, which include Facebook, Amazon, Tesla, and others that make up the biggest part of the weighting of this index.

To the upside, I think it is probably only a matter of time before we see the market break out to all-time highs, and perhaps go looking towards the 16,000 level. If we do break down below the 50-day EMA, then it is likely that the market could go looking towards the 14,500 level underneath, where we formed a double bottom. Anything below there has to be played via puts, because shorting this market is very dangerous to do.