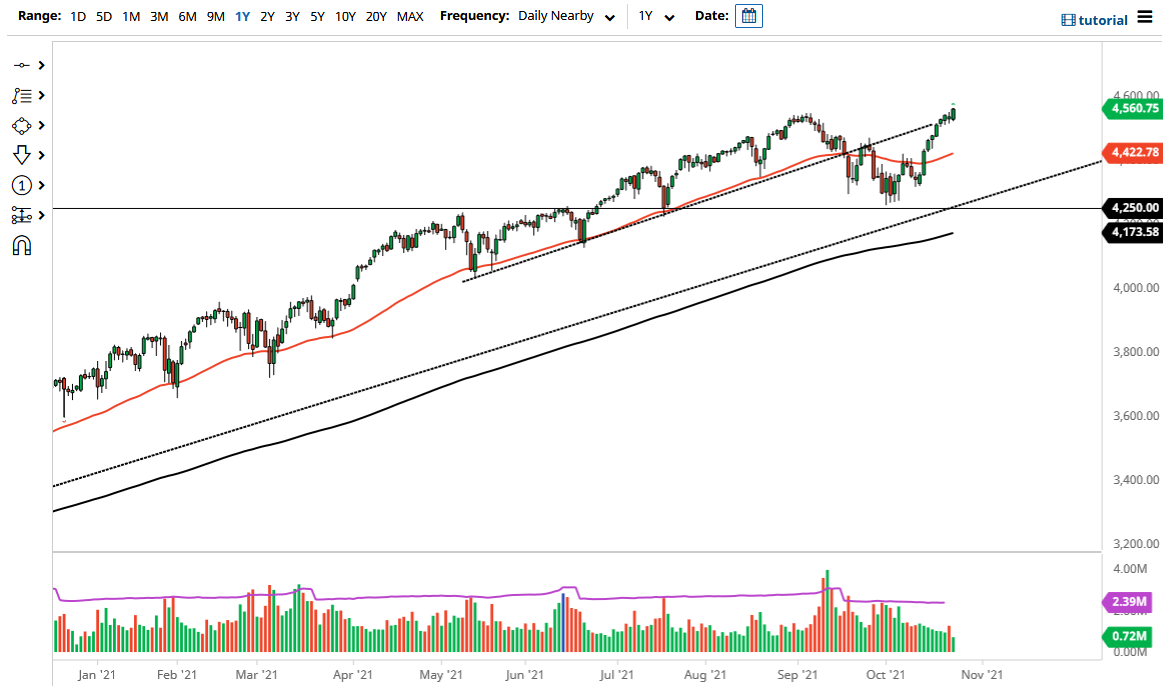

The S&P 500 has rallied rather significantly during the course of the trading session on Monday to break out to all-time highs. At this point, there does not look to be much out there that is going to get in the way of this market continuing to go higher. With this being the case, the market should continue to find plenty of buyers on dips, just as we have seen over the last couple of months. The S&P 500 continues to attract a lot of attention mainly due to the fact that the reopening trade should continue to put major pressure on the markets in general.

Pullbacks should continue to find plenty of support, especially near the 50 day EMA which sits just above the 4400 level. By doing so, the market looks as if it is well supported, and of course the 50 day EMA is also an area where we have seen a lot of noise in both directions. The market will continue to see a lot of interest, mainly due to the fact that there is so much in the way of liquidity out there that traders simply have no other alternative. Even if the bond yields are starting to pick up, they are nowhere near being a positive return when it comes to inflation, so therefore I think stocks will continue to see upward momentum due to that fact alone.

On the other hand, if we do break down below the 4500 level could bring in some fresh selling, but I do think that the market has plenty of support underneath that I would simply wait for some type of opportunity to pick up the market “on the cheap.” The 4250 level underneath will be a massive floor in the market, and if we can break down below there then I might be a buyer of puts, but I would not short this market. We are in the midst of earnings season, so that certainly has a certain amount of influence on the market as well. With this, I think the market is likely to see plenty of buyers willing to jump in it, so therefore I do think that by the end of the week we will be higher than where we start now. The Monday candlestick has been relatively strong, especially when you look at the previous few that were essentially neutral.