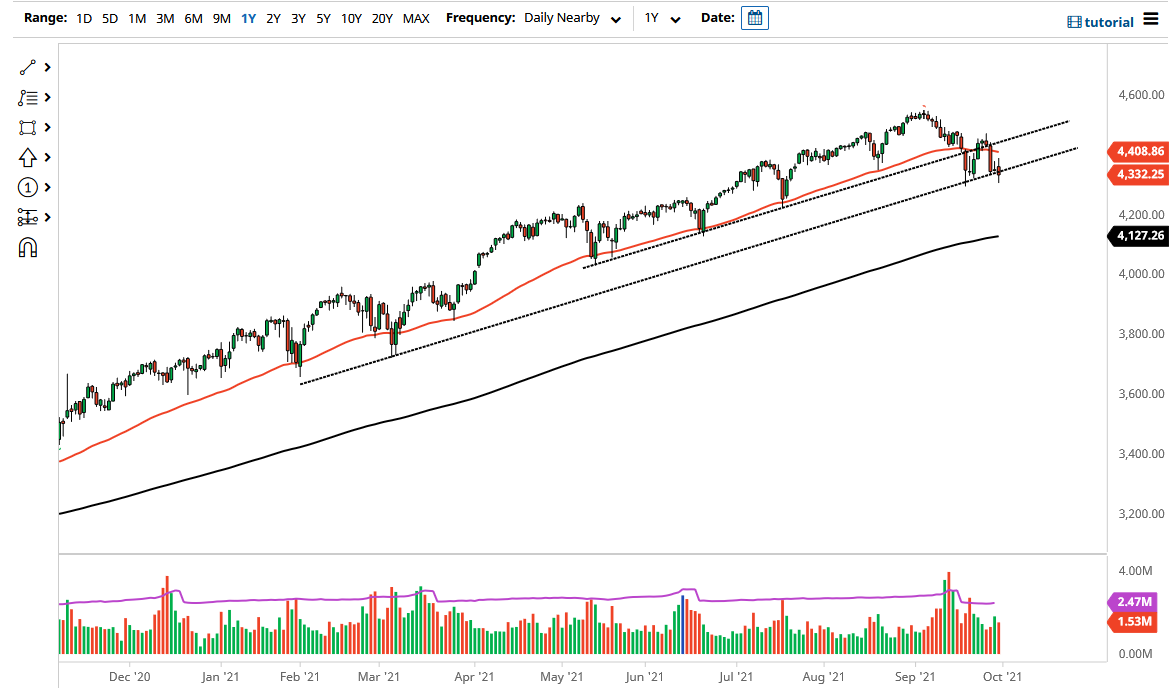

The S&P 500 continues to sit right at a major uptrend line, and even though we did initially tried to rally during the day, we have given back most of the gains to show weakness yet again. If we break down below the lows of the previous week, it is very likely that we continue to go much lower, perhaps opening up a move down to the 4200 level. At that point, I would be a buyer of puts, but that is about as bearish as I get with this market due to the fact that it is so highly manipulated.

If you think you are trading a free market, you are completely missing the point. It is a weighted index, meaning that it takes just a handful of companies to move it higher or lower. If we break down from here, that put buying opportunity presents itself, but Jerome Powell will say or do something to protect Wall Street if it starts to lose too much money. This has been the game for 13 years, as it is clear that the Federal Reserve works for Wall Street.

If we turn around a break above the 50 day EMA, then it is likely we will test the shooting star from the previous session, perhaps opening up a move towards the 4600 level over the longer term. Do not get me wrong, I do not think that is can happen easily, but it could very well be the case given enough time. At this point, I think the only thing that you are going to see and that you can count on is a significant amount of volatility. It is obvious to me that the stock market is hanging on by a thread, so I fully anticipate buying puts in the short term, but then looking for some type of value trade later. The market will continue to be very noisy, but I also believe that the market will eventually find its way back to the highs because that is what it does. The uptrend has been broken, but now the question is whether or not it is simply consolidation before continuation, or do we need to see some type of pullback? I would be cautious with my position size and only add once it shows a continuation in your direction.