The S&P 500 has rallied a bit during the course of the trading session on Thursday as we continue to see more of a push to the upside. Ultimately, this is a market that I think will eventually try to break out above the recent highs, thereby making it an all-time high. We are in the midst of the earnings season, and that of course is important to pay attention to.

It is not necessarily the earnings matter; it is just that it is a narrative that Wall Street will start to spend. At this point, it is all about liquidity in the end, as central banks continue to flood the markets with cash, it goes looking towards the stock markets in order to try to find a home. The fact that bonds cannot be bothered to return anything, the reality is that the traders out there have to get involved in the stock market because otherwise inflation will eat them alive. With that being the case, I think the stock markets continue to be the only game in town, and we should start looking towards the 4600 level. If we can break above there, then it is likely that we could go much higher.

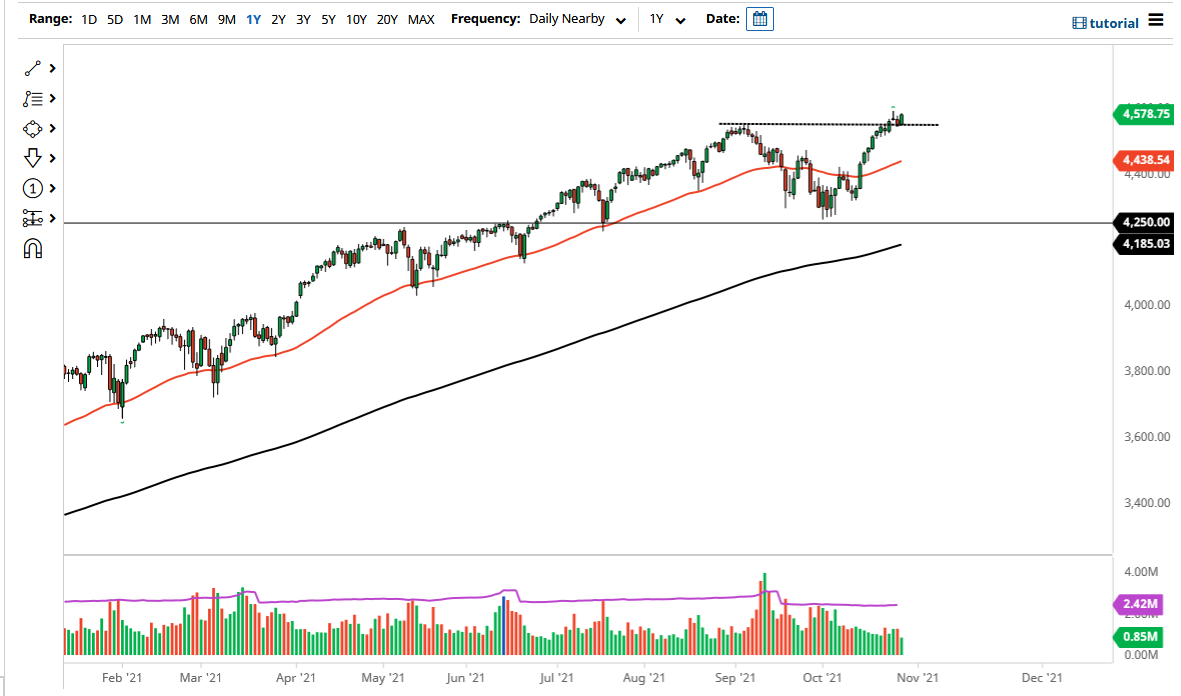

To the downside, if we break down below the 4500 level, then the market is likely to go looking towards the 50 day EMA. The 50 day EMA is sitting at the 4438 handle, where we would see a certain amount of support. That support should be rather important, but then again, I think that the 4250 handle is the absolute “floor the market”, and it is not until we break down below there that I would be looking to buy puts. I would not short this market, because quite frankly the market is one that you cannot short, so therefore puts are the only way you can express that opinion. I think any pullback at this point in time should be a nice buying opportunity based upon value more than anything else. We are a little bit overextended at the moment, but longer-term we still have much further to go. This nice reversal that we have seen as of late should continue to see plenty of interest. Longer-term, I believe we are going to 5000 above.