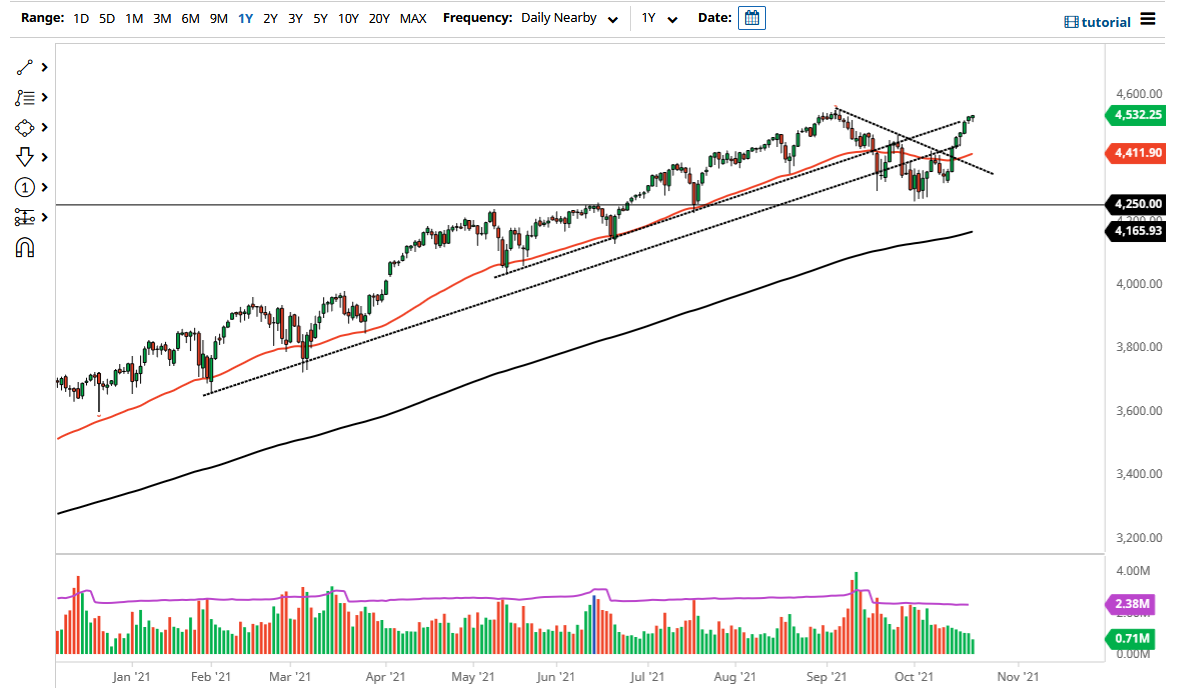

The S&P 500 has initially dipped lower during the trading session on Thursday, but then turned around to rally and form a hammer like candlestick. At this point, the market looks as if it is ready to break out to fresh, new highs, then continue the overall attitude that we have seen for the last 13 years. As we are in the midst of earnings season, it is very difficult to imagine a scenario where you can be a seller.

At the 4250 level, I think there is a significant “floor the market” that will be backed up by the 200 day EMA as it is grinding higher. That being said, if we were to break down below the 4250 handle, then I would be a buyer of puts. That could open up the possibility of a bigger move to the downside, but in order for the market to do that move, we would need to see a massive “risk off” type of scenario, something that we just do not have at the moment. I still like buying dips, which quite frankly has been the main trade for a majority of the last 13 years, going on 14.

The 4600 level will simply be but a footnote on the way higher, as we have so much in the way of momentum, but as we have seen a little bit of overextension, it is probably only a matter of time before we get some type of pullback, but that could open up the possibility to pick up a bit of value in a market that is very strong. The one thing you cannot do is short this market, so simply waiting for an opportunity to get long again would be the best way. I do not like the idea of buying at these elevated levels, but if we get some type of impulsive candlestick or make a fresh, new high, then I would have to jump into the fray. I do believe that longer-term we go much higher, if for no other reason than the fact that liquidity measures will continue to be made and even though the interest rates in the United States continue to climb, they are still rather low historically speaking. In other words, there probably will not be a major factor in determining where we go next.