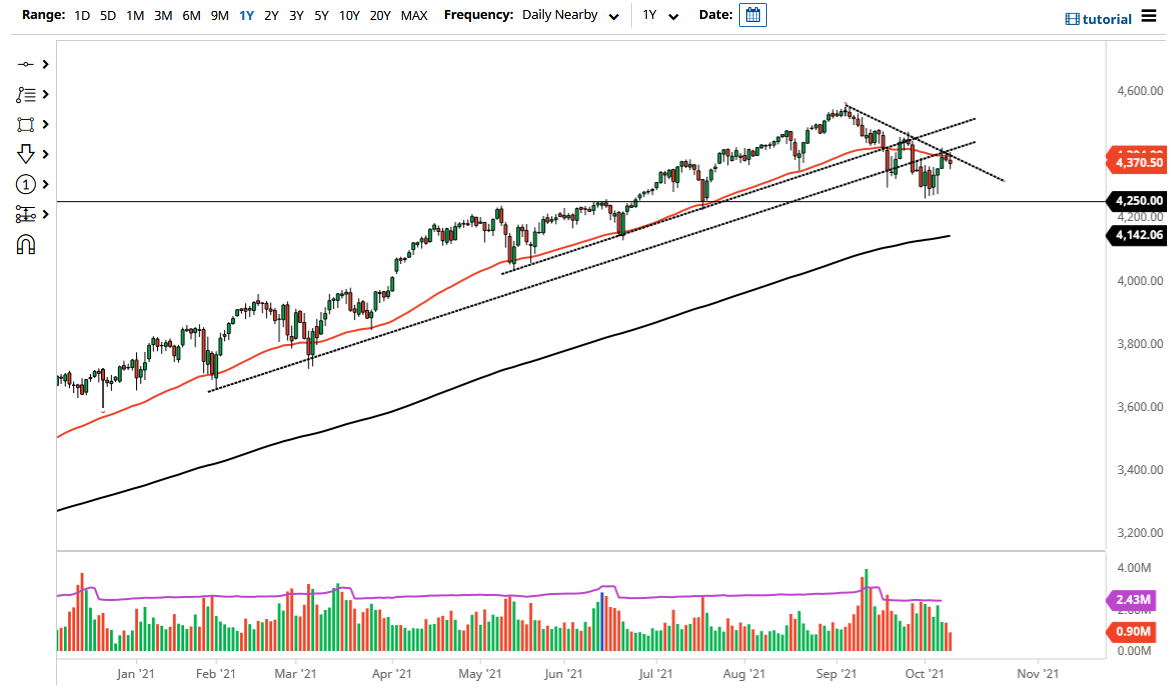

The S&P 500 rallied a bit on Monday but then pulled back as we continue to see a lot of volatility. The 50-day EMA is sitting right here as well, so that could offer a little bit of resistance, especially as there is also that downtrend line sitting right herel. In other words, there is a lot of noise right here that could cause a little bit of an issue for the uptrend. If we were to break above the highs of last week, then it is likely we will go looking towards the 4500 level, which is a large, round, psychologically significant figure. Breaking above there gives you an opportunity to get long again and hold onto a bigger move.

To the downside, if you break down below the candlestick for the trading session on Monday, then it is likely that we could go looking towards the 4250 level, an area that had previously been supportive. If we were to break down below there, then I think you could see the market break down towards the 200-day EMA. That would have me buying puts because I do not short this market. Shorting US indices is tantamount to fighting the Federal Reserve as they look at keeping in the stock market higher as their most important function.

We probably have a bit of noisy behavior ahead before we build up enough momentum. I am looking for some type of impulsive candlestick that I can follow, because it would show an increase in the momentum of either direction. I would prefer to be a buyer, because that is what this market does over time, it rallies. It is not an equally weighted index, and it is only about 10 stocks you truly need to follow in order to get bullish based upon the big companies moving in one direction or the other. The market will continue to see a lot of value hunters coming back into the market, so I think that it is only a matter of time before that happens, but the question is whether or not we will get that now, or after a more significant pullback. The choppiness should continue to be a major issue regardless of what happens next.