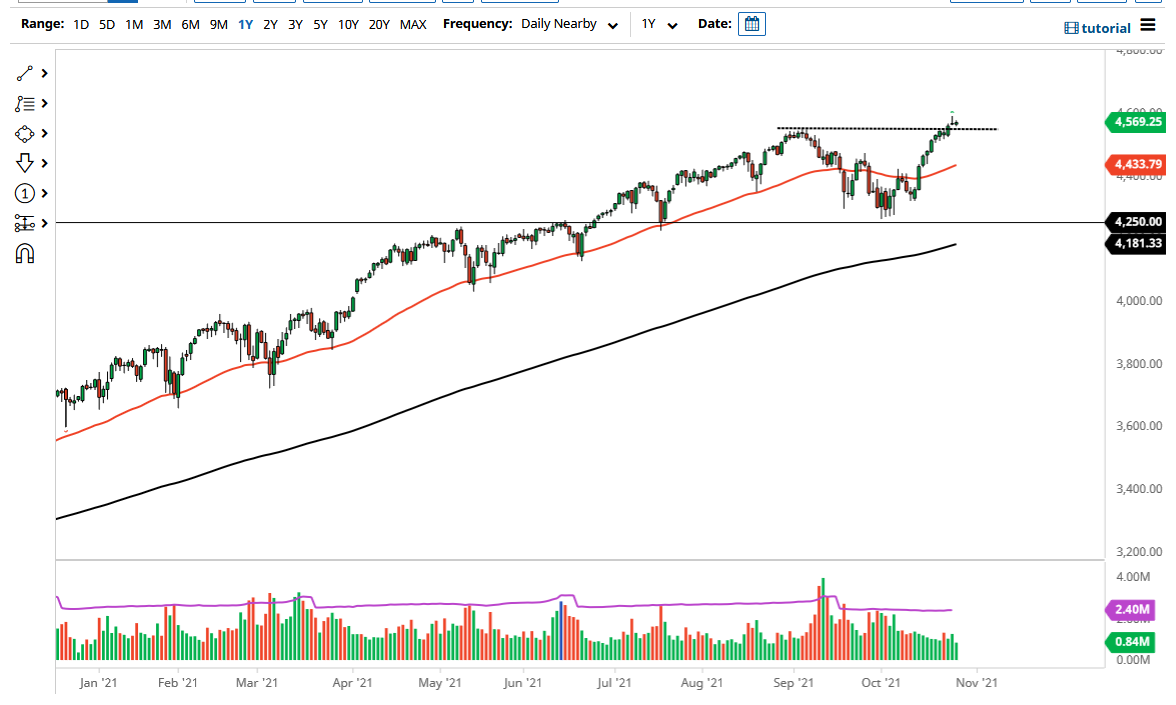

The S&P 500 went back and forth on Wednesday as we continue to hover near all-time highs. The 4500 level underneath continues to be a major support level, but at this point in time it is obvious that the market has shown itself to be willing to go higher, but we are digesting some of the gains that we have seen over the last couple of weeks. The market running out of momentum is not a big deal, but it does make sense that we would see a little bit of confusion in this general vicinity. Nonetheless, this is a market that I think given enough time will find plenty of buyers on dips.

When you look at this chart, it is obvious that the market has been in a bullish run for a while, but giving back some of these early gains does make sense that we would hang about in this general vicinity in order to build up the necessary confidence to stay at these higher levels. The S&P 500 continues to get a bit of a boost due to earnings season going fairly well, so at this point I think you need to look at this as a “buy on the dips” type of opportunity. When you try to find value, and it is quite often in the S&P 500 from a professional trader’s standpoint, we continue to see the reopening trade enter the imagination. This is a market that I think could continue to find the upward momentum to be the easiest way to play, as we have been in an uptrend for 13 years.

The Federal Reserve does everything it can to keep the markets afloat, so that is something you need to keep in the back of your mind. Ultimately, this is a market that you cannot short, but if we were to break down below the 4250 handle, then I might be a buyer of puts. Until then, I just do not see an argument for getting negative anytime soon. The S&P 500 continues to find favor due to the fact that although bond yields continue to rise, they are nothing in comparison to the true rate of inflation.