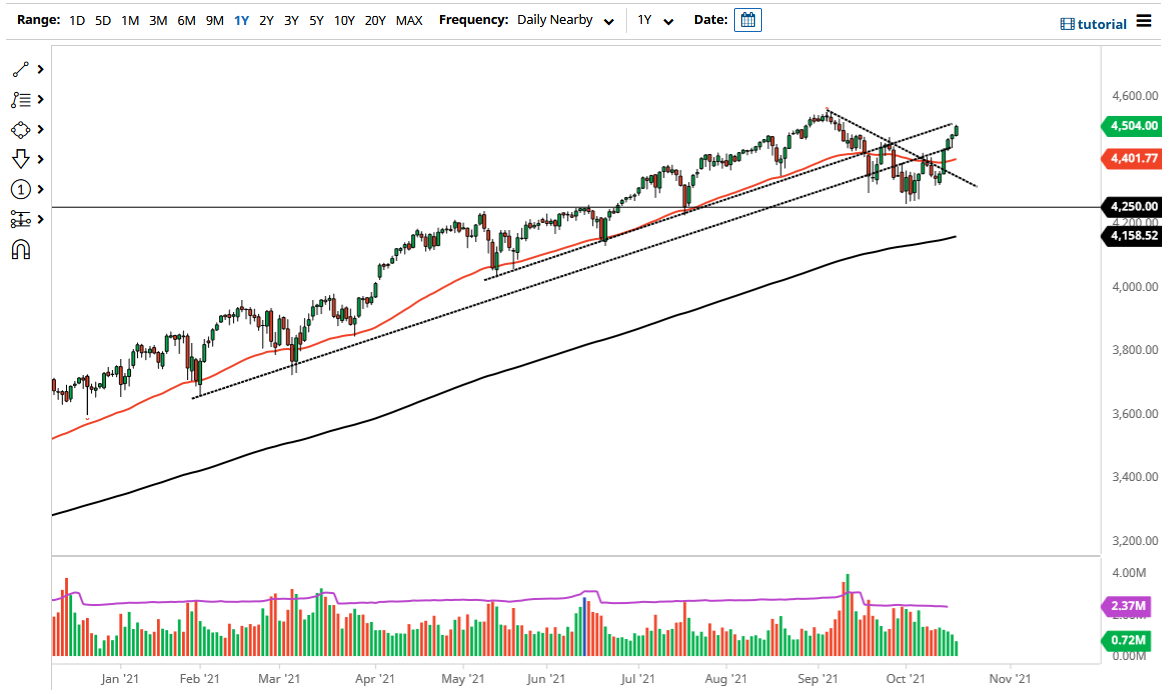

The S&P 500 rallied a bit on Tuesday to break above the 4500 level. By doing so, the market looks as if it is ready to go higher, and the fact that we have broken above significant resistance to kick off a rather significant “inverse head and shoulders” is worth paying close attention to. I think we are much more likely to see all-time highs now than to break down, but even if we were to pull back a bit, think there will be plenty of value hunters underneath to take advantage of that.

The 50-day EMA is hanging about the 4400 level, and the 50-day EMA is also starting to tilt a little bit higher. That does make sense that it would offer support due to the fact that both of those things are going on, so I do like the idea of picking up a bit of value. I think that is how this is going to play out throughout earnings season, that every time we pull back buyers will come in and take advantage of the market due to it offering “value.”

To the downside, it is not until we break down below the 4250 level that I would be concerned, as it is an area that has offered significant support previously, and one that would attract a lot of attention from a psychological standpoint. The market breaking through there then has me likely to buy puts, because I do not short this market. The market is one that is relentless, and clearly cannot be shorted overall. The 4600 level could offer a little bit of resistance, but at this point in time it is unlikely that we will stop there. I think we will go much higher, due to the fact that indexing continues to be a major driver of markets overall.

You can see that we had recently had a nice pullback, but we have all but forgotten that already. While it did feel like it was a significant turn of events and a complete change of attitude, you can see just how minor it was on the longer-term charts. That continues to be the main behavior of this market, as it has been for the last 13 years or so.