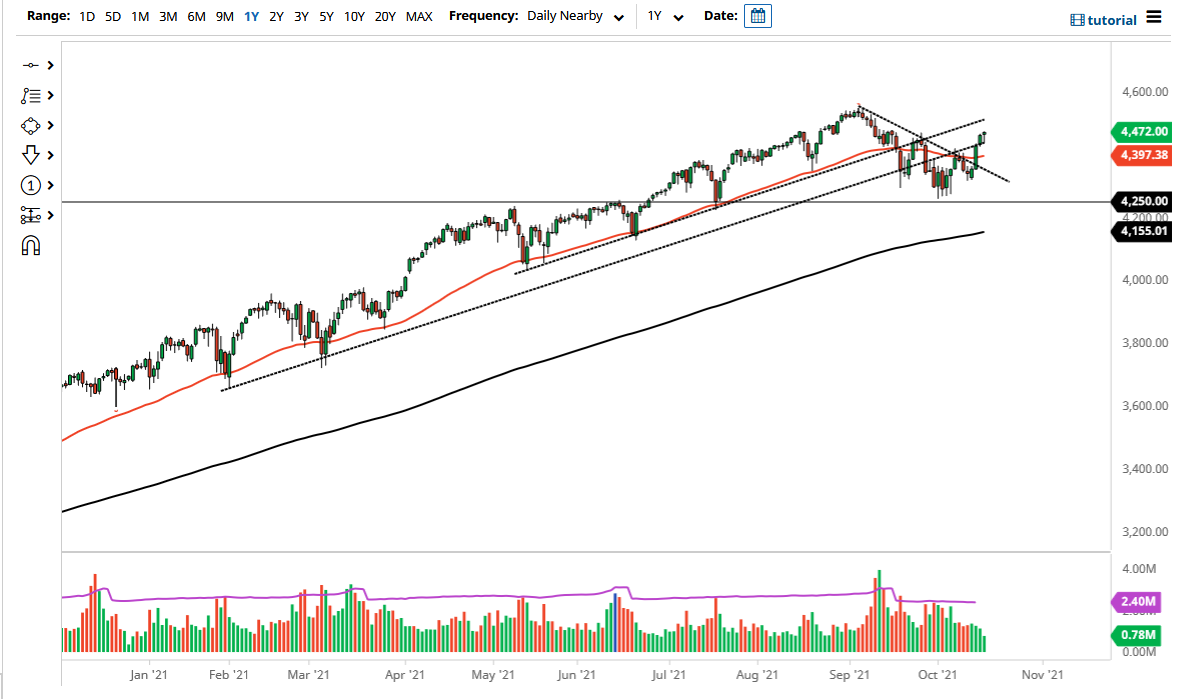

The S&P 500 pulled back a bit on Monday to show signs of weakness, but then turned around to show signs of life again. The market has broken to the upside, and it is likely that we will challenge the 4500 level. If we can break above the 4500 level, then it is likely that we would continue to go higher, as it would be the breaking of a large, round, psychologically significant figure.

Once we break above the 4500 level, then I see nothing here showing signs of significant resistance above, so I think we will simply continue the overall uptrend. The market has shown significant resilience, so it is difficult to imagine a scenario where I would get short of this market. Furthermore, the market has been in an uptrend for the most part of the last 13 years, as we have a significant amount of liquidity flowing into the market. Even if the Federal Reserve is going to taper, the reality is that they are not going to stop bond purchases. In other words, there is plenty of money flowing into the financial markets via the central bank over the longer term.

This is a market that has been a little bit extended over the last couple of days, but any short-term pullback at this point in time will attract plenty of value hunters. The 50-day EMA is starting to curl higher and should offer dynamic support going forward. If we did somehow turn around and break down below the 4250 handle, then I might be a buyer of puts, but I would not short this market as there is really no way to fight the Federal Reserve. As long as the Federal Reserve wishes to push this market higher, it will in fact go higher. The market will ultimately be one that continues to show plenty of choppy behavior, but more of an upward momentum than anything else. On dips I will be looking to take advantage of any signs of support that I can get on short-term charts. As mentioned previously, I might be a buyer of puts on a breakdown, but if we see that move lower, then I will get long as soon as I see stability.