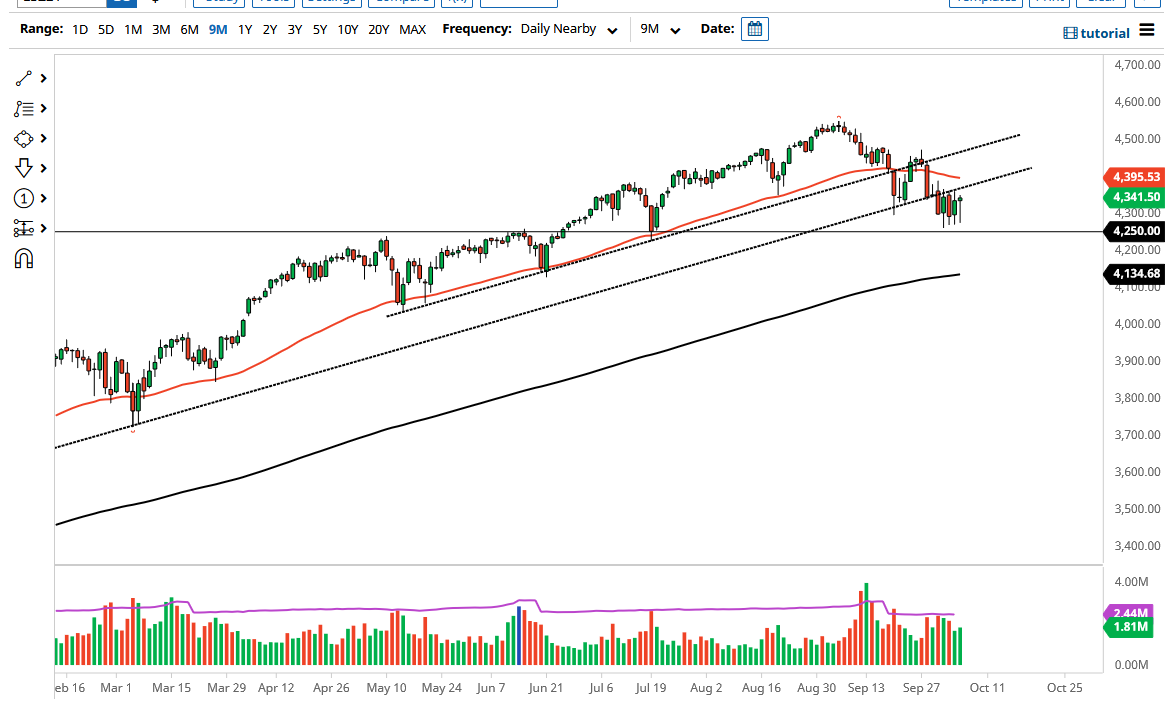

The S&P 500 fell significantly on Wednesday but found support just above the 4250 level yet again. By bouncing the way we have, we ended up forming a bit of a hammer. The hammer is a bullish sign, but we also have a lot of resistance just above and you have to pay attention to fact that Friday is the jobs number. In other words, it is very unlikely that we are going to make a huge move between now and then, but I suppose it is possible.

If we can break above the 50-day EMA, then the market is likely to continue the longer-term uptrend. That being said, I do not expect to see that happen very easily, because we would need to see some type of catalyst. The market breaking down below the 4250 level could open up a move lower, perhaps reaching down towards the 200-day EMA. The market continues to see a lot of noisy behavior, so you need to be cautious about the next couple of days. Regardless, I do not short these indices in the United States due to the fact that the Federal Reserve will continue to either jawbone the market or do something to pick it up. If we break down below the 4250 level, I might be a buyer of puts, but that would be about as aggressive as I would get to the downside.

In general, this is a market that I think continues to see a lot of headline issues, but we will probably have quite a bit of clarity starting on Monday, or perhaps even after the jobs number, depend on that figure and what it means. The shape of the candlestick is bullish, and I think it shows just how much is sitting just underneath. So if you are a short-term trader, you probably will look at short-term charts in a “buy on the dips” type of situation. Otherwise, you probably should stay on the sidelines between now and the jobs figure, unless you are very nimble and have the ability to watch the charts very closely. If not, by the time Monday rolls around, you will probably have clarity that you can take advantage of.