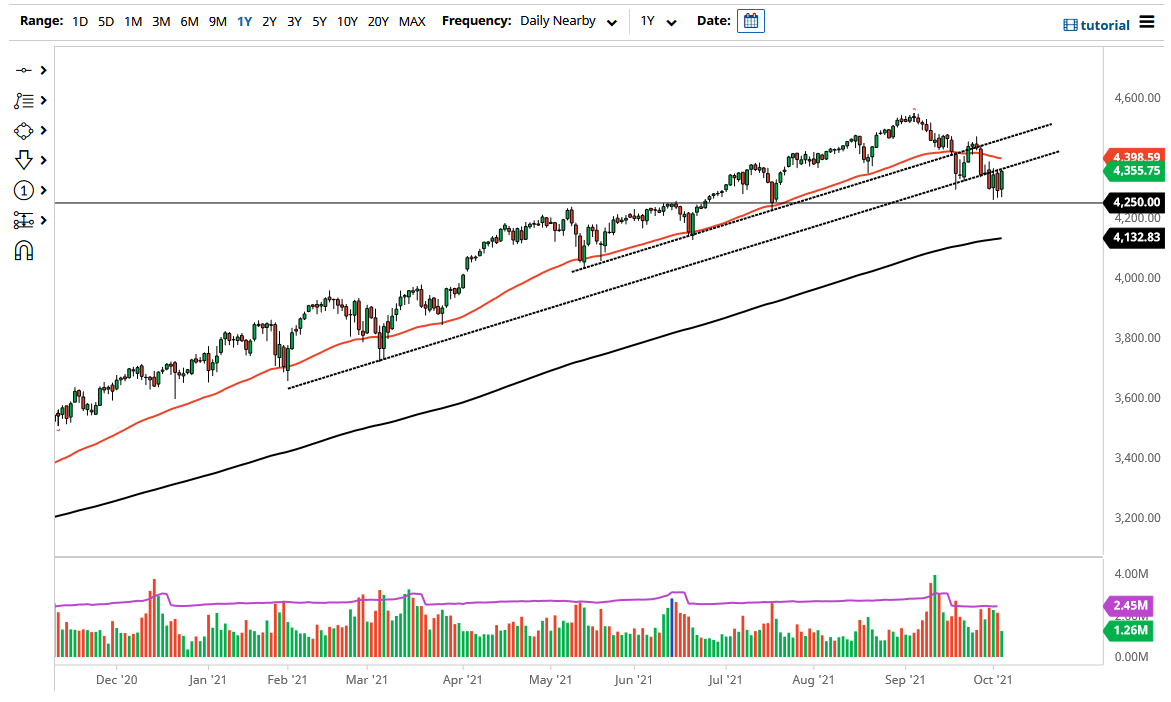

The S&P 500 initially dropped a bit on Tuesday but has seen the 4250 level offer significant support yet again. The index thus bounced to the upside and is looking towards the resistance barrier right around 4350 as well. With that being the case, the market is likely to continue to see choppy trading in this general vicinity as we try to figure out where we are going next. Another thing that could keep this market somewhat sideways is the fact that we have the jobs number coming out on Friday, and that will have a significant influence on the market. With that in mind, keep your position size somewhat small.

If we were to break down below the 4250 level, then it would signify a potential move lower. At that point, then I think you would go looking towards the 200-day EMA, which is sitting at the 4132 handle. The 200-day EMA will attract a lot of attention, and it is also worth noting that it would be roughly a 10% drop from the absolute highs, so that would be a typical correction as defined classically. Breaking down below the 200-day EMA would be a very negative turn of events, and it would open up the possibility of a move towards 4000. That being said, if we do break down below the 4250 handle, I am a buyer of puts and not somebody who would short this market due to the fact that the Federal Reserve will jawbone the market back to the upside, and it is also possible that we could see them get involved in the bond market yet again. Because of this, I think the downside is somewhat limited.

Looking at the chart, if we can break above the 50-day EMA, then I think it allows the market to recover fully and go looking towards the highs again. I do not necessarily think that is going to be easy to make happen, but it is probably easier than a sustained breakdown. With that in mind, I think we are more or less in a “wait and see” type of situation between now and the non-farm payroll announcement coming out Friday early morning in New York.