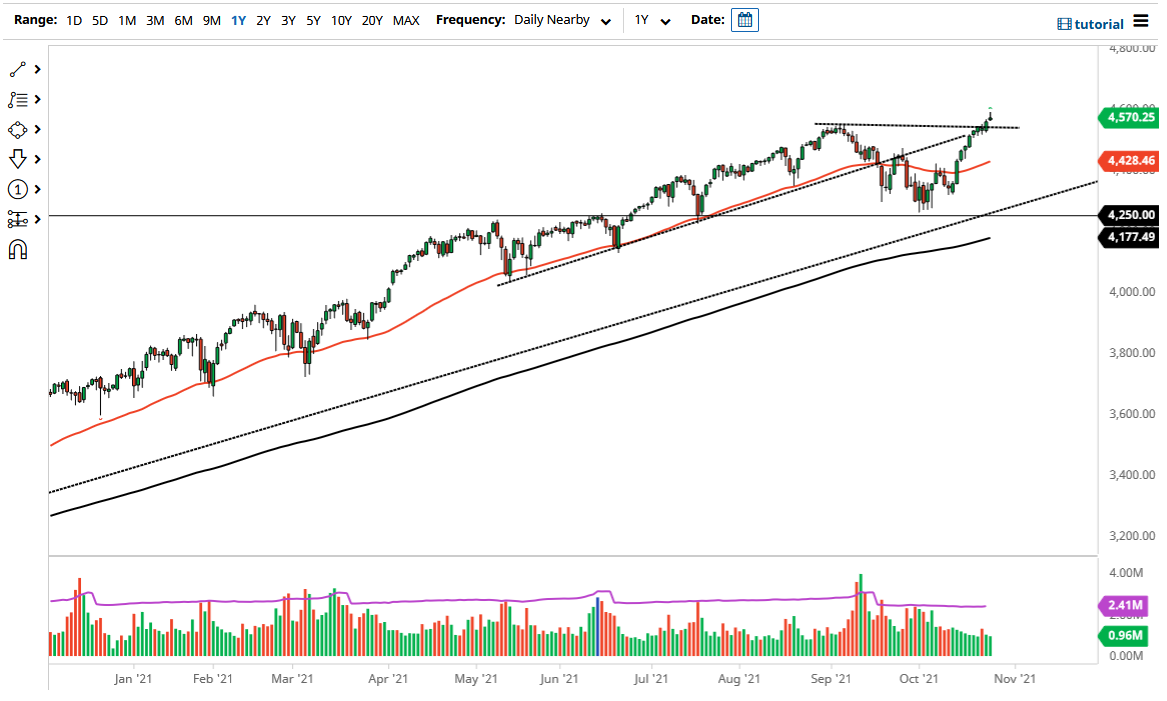

The S&P 500 has rallied a bit during the trading session here on Tuesday but gave back early gains as we are getting a little bit stretched. Quite frankly, any pullback at this point in time will probably be thought of as a buying opportunity before it is all said and done, so I certainly would not be a seller. I think at this point we are more likely than not to see value hunters come in every time they get an opportunity, with a particular eye on the 4500 region.

The 50 day EMA sits right around the 4428 level and is starting to slope higher. That of course is an indicator that a lot of people pay close attention to and use for entry points. Below there, we have the 4250 level, which is massive support, and an area where buyers have been very active. The 4250 handle underneath could be a potential area to buy puts, but quite frankly you cannot short this market due to the liquidity out there and of course the fact that every time traders have tried to do that, if they were not very nimble, they got their heads handed to them.

If we break above the top of the candlestick for the trading session on Tuesday, then it is just yet another charge higher, as we would break above the 4600 level. At that point, then I think the market will continue its overall attitude to the upside, and the fact that we are going so well during the earnings season makes me think we will continue to see upward pressure more than anything else. If we can break above the 4600 level, then I anticipate it will simply be the next leg higher in what has been a relatively reliable uptrend. The S&P 500 getting through earnings season relatively unscathed of course is important, so the next couple of days could lead the direction for the next couple of weeks. Because of this, you need to be very cautious in general, but clearly there is only one direction to trade this market. The shape of the candlestick does suggest perhaps a little bit of a pullback, but nothing more than just that. The market is light years away from forming some type of major negative downtrend and therefore it should be thought of in that sense.