The S&P 500 did very little on Friday as most traders were trying to figure out what the paltry jobs report for the second month in a row means. Because of this, I suspect that a lot of traders will be digesting the fact that we only added 194,000 jobs in the United States last month over the weekend. After all, there was an anticipated rate of 500,000 for the month of September, so it was a huge miss.

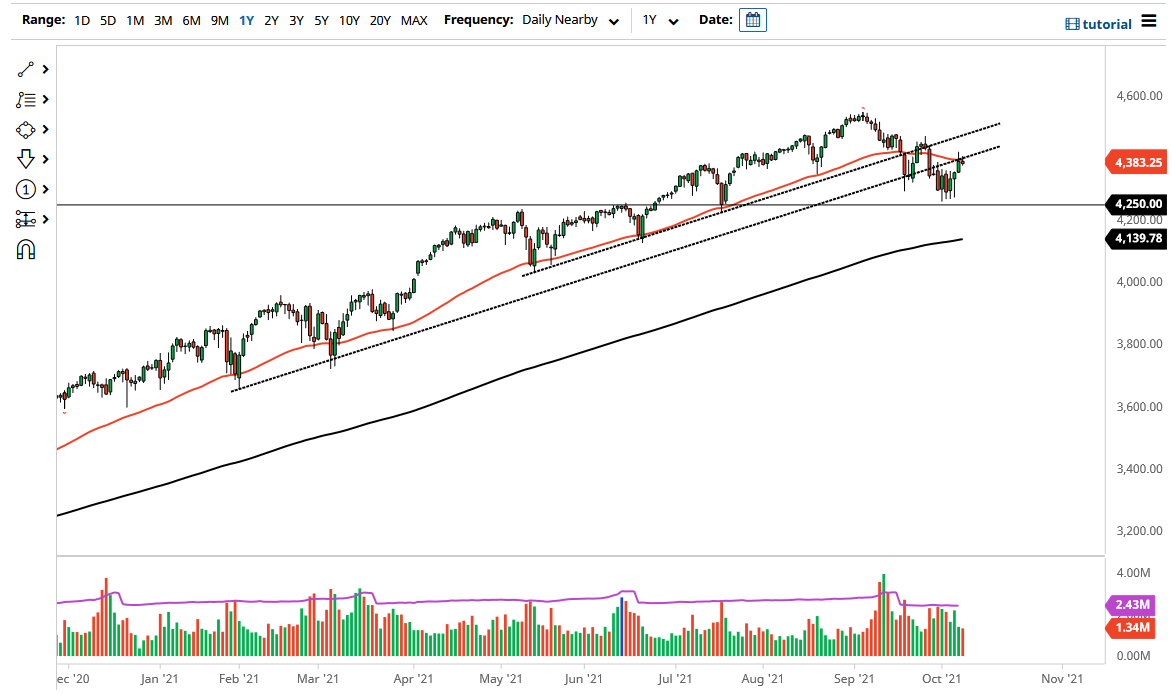

If we do pull back from here, the market is likely to go looking towards the 4250 level, an area where we have seen a lot of support. I like the idea of buying pullbacks to show signs of a bounce, but if we break down below the 4250 level, then I would be a buyer of puts at that point. Once this happens, I suspect that we would go looking towards the 200-day EMA rather quickly, and perhaps even the 4000 level. I will be a short seller though, because it is only a matter of time before the Federal Reserve steps in and either jawbones the market back to the upside or starts buying things again.

On the other hand, if we do break above the highs of the Thursday session then it is likely we could go looking towards the 4500 level, maybe even higher than that to make a fresh all-time high. Longer term, I do think that will continue to be the case, but we have a lot of work to do between now and then in order to get there. Interest rates rising has worked against the value of the market, so that is something to pay close attention to.

I think the only thing you can count on is a lot of choppy behavior in the short term, and it is likely that you need to be very cautious with your position size over the next couple of weeks until we get some type of clarity. There are lot of questions as to whether or not the Federal Reserve is going to taper and how aggressively, so I think you need to buckle up because the next couple of weeks are going to be very rocky.