Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken before 5pm Tokyo time Friday.

Short Trade Idea

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 115.17.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 113.20 or 113.03.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

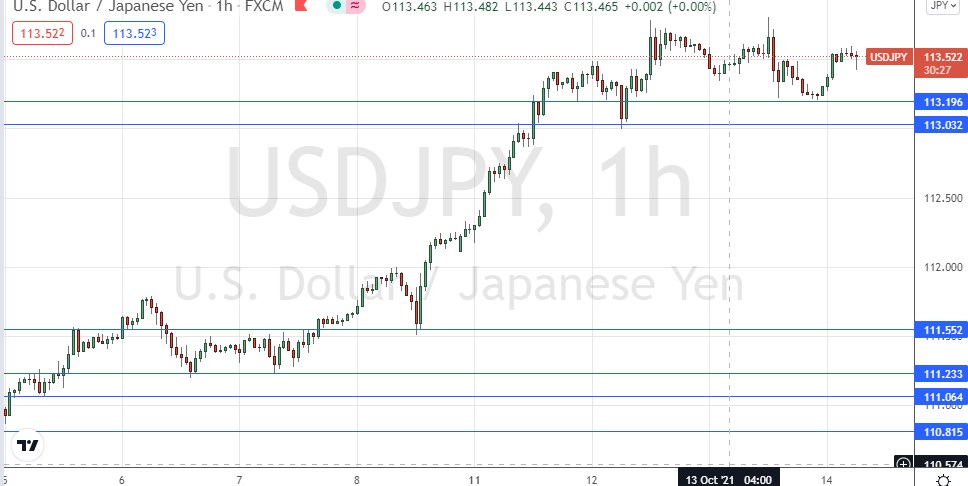

USD/JPY Analysis

I wrote last Tuesday that this currency pair was now in a very bullish position, breaking with strong momentum to a new 1-year record high price. I therefore thought there would likely be good long trading opportunities over the coming days, and that the price had potential to rise all the way to 115.17.

This was a good call insofar as the price has held up although it has not really advanced over the past two days. Short traders would have been disappointed.

The USD has lost some of its attractiveness after getting knocked down yesterday following higher than expected US inflation data released yesterday. However, the yen remains weak, and this has been enough to hold the price up over recent hours. Nearby key support remains unbroken, which is a bullish sign. However, the short-term price action suggests a downwards price movement is most likely over the coming hours.

The big question most relevant to this currency pair now seems to be whether the USD recovers or not. If the dollar remains weak, that would be a sign that higher inflation may begin to weaken the dollar instead of boost it as has been seen over recent months, due to the expectation that it would result in a rate hike. If the USD weakens, weakness in the yen will likely be easier to exploit in yen crosses such as the EUR/JPY and maybe even the GBP/JPY.

In any case, for the time being I am still ready to enter a long trade in this currency pair from any bullish bounce we may get at either 113.20 or 113.03.

Concerning the USD, there will be a release of PPI data at 1:30pm London time today. There is nothing of high importance today scheduled regarding the JPY.