Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered prior to 5pm Tokyo time Wednesday.

Short Trade Ideas

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 113.20 or 115.17.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 113.03.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

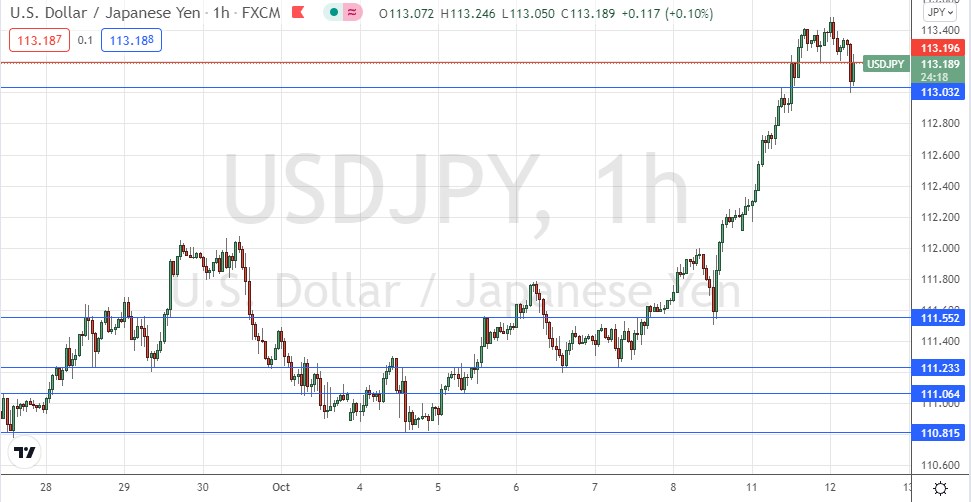

USD/JPY Analysis

After a very long period of ranging in a choppy style with very low volatility, the last week has finally seen a very strong and decisive bullish breakout by the USD/JPY currency pair with dramatically higher volatility. Yesterday’s strongly bullish daily candlestick was almost twice the recent average true range, and it closed very near the top of its range, well above the round number at 113.00. The price reached a new 2.5-year high.

These are all very bullish signs, but sometimes the price needs a small pullback or consolidation after such a strong price movement, and we have been seeing that in recent hours. There is an obvious support level confluent with the round number at 113.00 which has held as we enter today’s London session. There is what looks to be an initial sign of a resistance level at 113.20 but I would not want to take a short trade from a rejection of this level. Instead, it could be useful as a benchmark for entering a new long trade, perhaps by waiting until the price is established above 113.20 before going long.

The US dollar has been in a well-established bullish trend for some time, and the USD/JPY is one of the major currency pairs through which US dollar trends are expressed. However, the recent strong bullish breakout seems to have been driven more by new weakness in the Japanese yen as the US dollar was strong for a long time without moving much at all against the yen. This suggests that we are seeing an uncoupling of the Japanese yen from its well-established role as a risk-off currency, as we can see US stock markets falling while the yen falls strongly too.

There are no key resistance levels between 113.20 and 115.17 so the price can quite easily take off again and continue all the way to the big round number at 115.00. Forex traders are likely to see some good long trading opportunities here over the coming days, if not necessarily today which may see a minor fall or consolidation.

I will look for long trades only here today.

There is nothing of high importance scheduled today regarding either the JPY or the USD.