The US dollar pairs in the Forex market are looking to the announcement of the US economic growth rate today. Results that are stronger than expectations will raise expectations of an imminent tightening of the Federal Reserve's monetary policy. Ahead of today's important events, the price of the USD/JPY currency pair has fluctuated in a range between the 113.38 support level and the 114.31 resistance level since the beginning of this week's trading. It settled around the 113.52 level at the time of writing the analysis. The US dollar is still the strongest with expectations of tightening the US central bank's policy, and the results of US economic data in the recent period gave those expectations more impetus.

Today, the Bank of Japan stood by its stimulus stance while pointing to a further delay in the economy's recovery after the outbreak of the epidemic, just days before new Prime Minister Fumio Kishida faces his first national elections. While the Bank of Japan kept interest rates and asset purchase plans unchanged today, it lowered its forecast for economic growth this fiscal year to reflect setbacks from the summer COVID wave and supply chain problems. It also downplayed its view on exports and production, citing supply constraints.

The Japanese central bank's decision comes amid calls for government spending to support the economy as the nation heads to the polls in a political race centered on issues of income inequality. Although Kishida's ruling coalition is likely to retain control in Sunday's vote, the poor performance could increase pressure on the new prime minister to boost the size of the stimulus package he has pledged.

The Bank of Japan also cut its inflation forecast to zero in another indication of how out of sync Japan's prices are with the rest of the world. The price cut was largely due to a reorganization of the consumer price basket that focuses more on phone charges, which have fallen sharply under government pressure, making it difficult to gauge the trend of core inflation in Japan.

The Bank's projections for the coming years show that it still expects price momentum to remain weaker than in other countries. The latest estimate from the Bank of Japan shows that core inflation is only halfway to its 2% target by 2023, which means the bank is likely stuck in easing for the foreseeable future while other central banks take action.

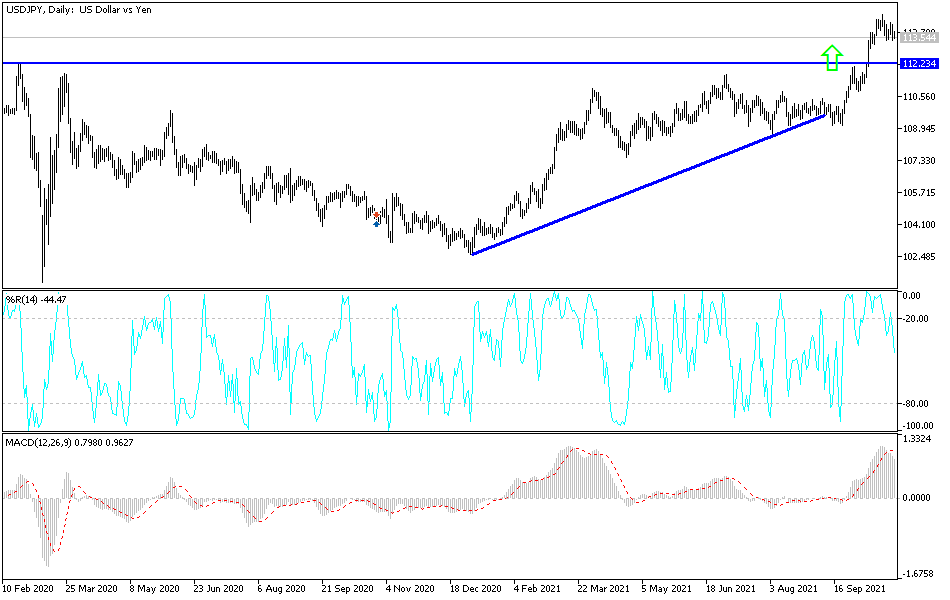

Technical Analysis

Despite the recent performance, the general trend of the USD/JPY pair is still bullish, and it close to breaching the 114.00 psychological resistance again. On the downside, the closest targets are currently 113.30, 112.45 and 111.80. I still prefer selling USD/JPY from every bullish level.