The Japanese yen appears to be at the mercy of US inflation expectations, which means that current selling is likely to stop unless expectations of US interest rate hikes persist. The price of the USD/JPY currency pair rose by more than 3%, reaching the resistance level of 114.70, its highest level in years, before settling around the level of 113.95 as of this writing. The ratio between three-month long options and put options on the USD/JPY - the so-called risk reversal - closely tracks a commonly used measure of market expectations of US consumer price gains, which is five years. With inflation expectations rising, this dynamic has helped make the Japanese currency the worst performer this month among its G10 peers.

The Japanese yen weakened by more than 10% for the whole of 2021. Meanwhile, strong economic growth in the US coupled with supply chain difficulties and commodity shortages has pushed inflation expectations to levels not seen since 2017. The result is that those expectations of price gains may need to keep rising from here for the yen to maintain the momentum.

According to currency analysts at Societe Generale, further downside for the Japanese yen could include closing points higher around 3% and fresh selling in the bond market, which is now on hold, but with positions on the currency likely to have peaked, the move could falter for the USD/JPY if it fails to reach 115 this week. Data from the Commodity Futures Trading Commission show that speculative bets on the yen have already increased in the past few weeks. While this may go further, it could also mean that traders may soon be looking to hit the brakes on the final move.

Commenting on the future outlook for the currency pair, Viraj Patel, strategist at Vanda Research said: “The yen positioning is very bearish, and this increases the hurdle for selling momentum to continue.” He says that USD/JPY is likely to fall back to around 112 or 113 and that the pair is likely to take a breather if Treasury yields and inflation expectations stabilize.

The US dollar was on the decline against several major currencies in October, but the Japanese yen was a notable exception, which continues to be affected by the US currency. Last week, the USD/JPY pair rose 1.78%, its best weekly performance since March 2020. Yesterday, the USD/JPY pair rose to a high of 114.69, the highest level since March 2017.

The widening spread between US and Japanese sovereign bond yields in the past few weeks was also a good reason for the pair's sharp rise. The 10-year yield spread has widened by 20 basis points since late September, sending the yen sharply lower as the currency is very sensitive to yield spreads.

The yen was also faltered by expectations that the Japanese government will embark on another massive stimulus package after the October 31 national elections. Prime Minister Fumio Kishida should win the election easily and is likely to implement more monetary easing and spending in order to push inflation higher, as the weak economy may show deflation.

With the US and Japan heading in opposite directions in terms of monetary and fiscal policies, Forex traders will not be surprised to see the USD/JPY continue to rise and move towards the psychological level of 120 in the short term. Finally, the sharp rise in oil prices is also weighing on the yen, since oil prices are defined in US dollars. The Japanese government will not mind a weak yen, as this should help boost the country's export sector.

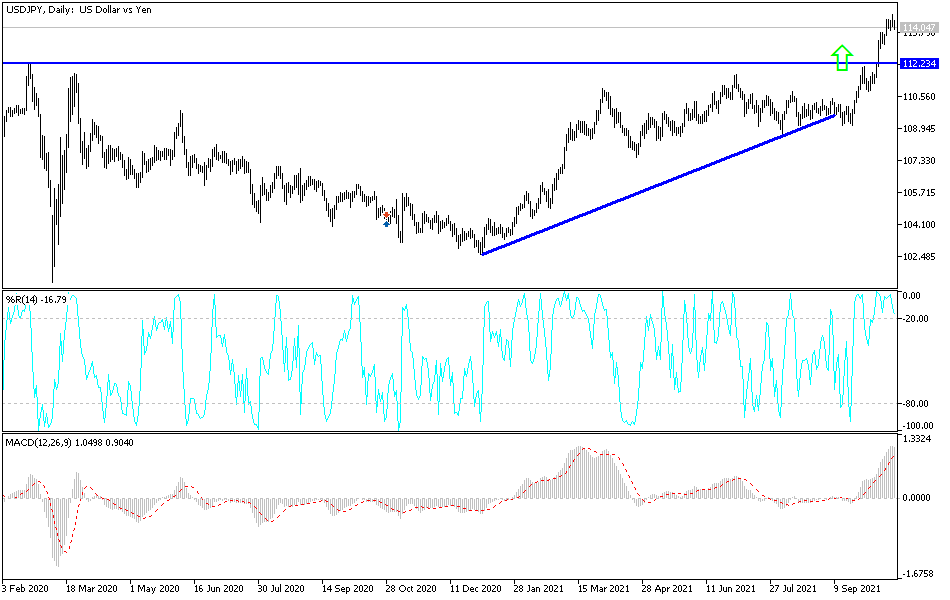

On the daily chart, the gains of the USD/JPY pushed the technical indicators towards strong overbought levels. Therefore, I expect profit-taking soon, which may start at the resistance levels of 114.60, 115.20 and 116.00. The trend will not reverse unless the bears move towards the support level at 112.30 first.

The US dollar will be affected today by the announcement of the weekly jobless claims, the Philadelphia Industrial Index and the US existing home sales.