For the second day in a row, the USD/JPY currency pair returned to stability around and above the 114.00 psychological resistance. Yesterday's gains extended to the 114.31 level, and settled around the 113.95 level at the time of writing the analysis. The bulls' dominance is still in place, as the US dollar is supported against the rest of the other major currencies, amid strong expectations of the imminent date of tightening the US Federal Reserve's policy. On the other hand, the Japanese yen is under pressure ahead of the Japanese elections at the end of this month.

The Fed signaled this week that it is on track to taper quantitative easing faster than expected. Most likely starting from mid-November or mid-December and ending by the middle of next year. "It should continue to put upward pressure on short rates in the US and the US dollar going forward," says Lee Hardman, currency analyst at MUFG.

The minutes of the Federal Reserve's September meeting last week confirmed that the US central bank is likely to start tapering its quantitative easing program in either November or December, while the FOMC's expectations last month of higher interest rates from 2022 held in support of the dollar. The risk, however, is that the Fed will eventually follow in the BoE's footsteps by preparing markets for an immediate or faster process of interest rate normalization than has been directed so far.

The market is in a strong position for further dollar upside, so much so that the situation is now overcrowded with the crucial November 3 Federal Reserve (FOMC) policy meeting approaching. And the latest Commitment of Traders Commitment Report from the CFTC shows that putting the dollar to the upside remains the most popular bet among the G10 currencies, to the point where investors are now holding their largest net long US dollar positions since early 2020.

Accordingly, Stephen Gallo, FX Analyst at BMO Capital says: “The bulk of this long US dollar position has been built since the August 24 IMM positioning survey conducted by the CFTC. “The position has not conflicted with those who hold it, the dollar is up about 0.3% since late August, but it hasn’t exactly been a gradual domestically, and now it is quite clear that it is a crowded bargain,” Gallo adds.

The dollar's gains come as investors increase bets, the Fed will begin to scale back its asset purchase program (to end quantitative easing) in November, laying the groundwork for a possible interest rate hike in 2022. The dollar also benefited more broadly from the ongoing US economic recovery that has outpaced the recovery The global trend, while sporadic periods of harsh investor sentiment have also prompted investors to reach for the dollar.

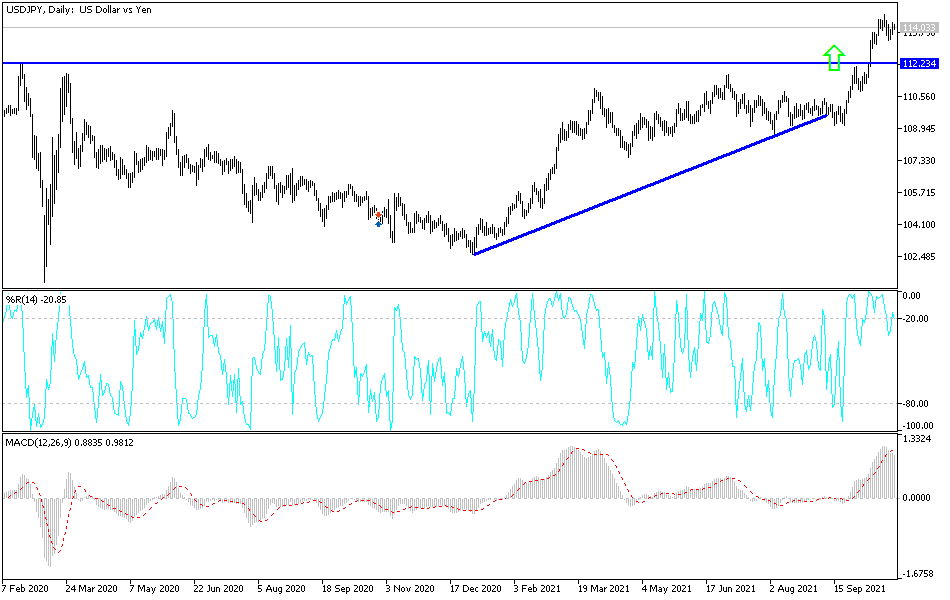

Technical Analysis

So far, the general trend of the USD/JPY pair is still bullish. If there is a failure to continue the current situation, especially above the resistance 114.00, a head and shoulders formation will appear on the daily chart, which paves the way for strong and continuous profit-taking that may lead us to the support levels 113.65, 112.80 and 112.00, which are levels that shake the current bulls' control. On the other hand, the breach of the resistance 114.70 will motivate the bulls to stick to the trend and at the same time move the technical indicators towards strong overbought levels. I still prefer selling the currency pair from every ascending level. The US dollar will be affected today by the announcement of the US durable goods orders numbers.