The USD/JPY has been strongly bullish, hovering above the 110.00 psychological resistance last week amid increased risk appetite for the US dollar. This was due to strong expectations that US interest rates will be raised soon, and the pair headed towards the resistance level of 112.08, which is the highest price since February 2020, and closed trading around the level of 111.06. The pair is awaiting the details of the US jobs report this week, whose results may confirm expectations regarding the future of the Federal Reserve's policy or confirm that COVID variants still negatively affect the course of economic recovery.

Japan has chosen its new prime minister, and the markets are awaiting the new official's policy towards reviving the Japanese economy, amid the increasing pace of vaccination against the epidemic in the last days of Suga's presidency.

In addition to monitoring the economic performance of the United States, to determine the most appropriate time to tighten the Fed's policy, it is necessary to monitor the course of COVID, especially the Delta variant, which dominates the world. The death toll in the United States from COVID-19 passed the 700,000 mark late Friday — a number more than the population of Boston. The last 100,000 deaths occurred at a time when vaccines - which greatly prevent deaths, hospitalizations and serious illness - were available to any American over the age of 12.

That achievement is deeply frustrating for doctors, public health officials and the American public, who watched the epidemic that began to decline earlier in the summer take a dark turn. Despite most of the country being vaccinated, the cases keep rising. Tens of millions of Americans refused to get vaccinated. Thedelta variant continues to spread across the country and send the death toll from 600,000 to 700,000 in 3½ months.

Florida has suffered by far the most deaths of any state during that time, with the virus killing about 17,000 residents since mid-June. Texas came second, with 13,000 deaths. The two states account for 15% of the country's population, but more than 30% of the nation's deaths since the nation crossed the 600,000 threshold, despite the fact that most of their populations are fully vaccinated.

When deaths passed 600,000 in mid-June, vaccinations were already reducing the number of cases, restrictions were lifted and people looked forward to life returning to normal during the summer. The daily death rate in the United States has fallen to an average of about 340, from a high of more than 3,000 in mid-January.

But as the delta variant has spread in the country, the number of cases and deaths has soared—particularly among unvaccinated people and young adults, with hospitals across the country reporting significant increases in admissions and deaths among people under 65. They also report significant infections and deaths, albeit far lower rates, prompting efforts to provide booster shots to vulnerable Americans.

Now, the average daily US death rate is about 1,900 per day. Cases have begun to decline from their highest levels in September, but there are fears the situation could get worse in the winter months when cold weather drives people indoors.

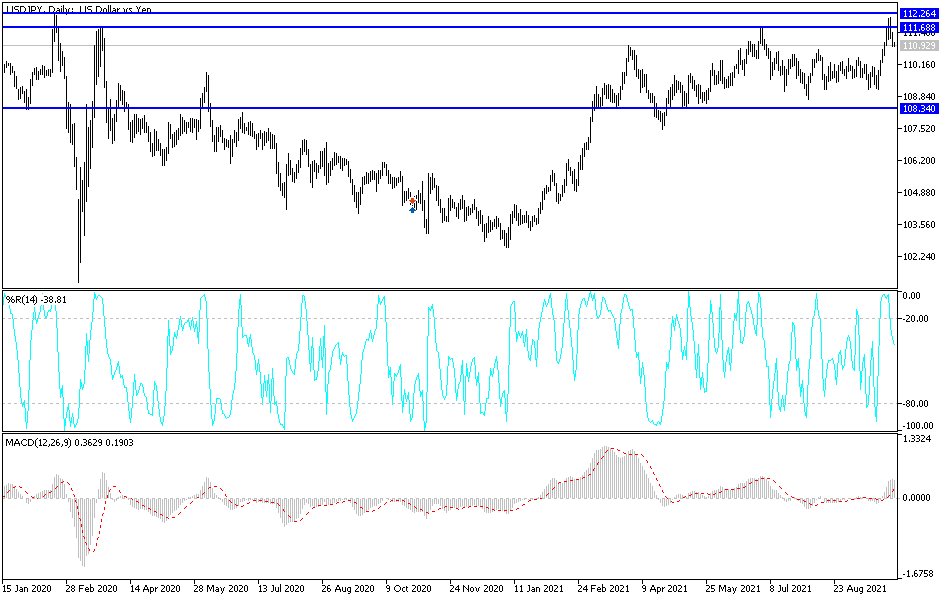

Technical analysis of the pair

The general trend of the USD/JPY pair will remain bullish as long as it is stable above the 110.00 psychological resistance, which motivates buyers to rush towards stronger upward levels. Bearing in mind that moving towards the resistance 112.40 will push the technical indicators towards overbought levels, and unless the dollar gains more momentum, the short positions will be activated to take profits quickly.

On the downside and according to the performance on the daily chart, the pair moved towards the 109.45 support level, a breakdown of the current bullish outlook. The currency pair will be affected by risk appetite.