The USD/JPY's recent rebound gains came to a halt at the 114.46 resistance, a 3-year high, and settled around 114.10 as of this writing. This comes ahead of the US housing numbers being announced later on. If Forex traders are wondering when to take profits, this will depend on whether or not there are continued expectations of the Federal Reserve tightening its policy, and also the extent of risk appetite, in light of the pandemic and the new Japanese government’s policy to revive the third largest economy in the world and its relations with allies.

The US dollar fell against most of the other major currencies after a report from the Federal Reserve showed an unexpected sharp drop in US industrial production in September. The Federal Reserve said industrial production fell -1.3% in September after declining 0.1% in August. The sharp decline surprised economists who had expected industrial production to rise 0.2% compared to the 0.4% increase originally reported for the previous month.

Industrial production fell 0.7%, with production of cars and parts down 7.2% amid a shortage of semiconductors, the report added. Utilities production was also down 3.6%, as demand for cooling waned after a warmer-than-normal August, while mining production fell 2.3% due to the continuing effects of Hurricane Ida.

A report from the National Association of Home Builders showed a marked improvement in the confidence of homebuilders in the US in October. The report said the NAHB/Wells Fargo Housing Market Index rose to a reading of 80 in October from 76 in September. Economists had expected the index to be unchanged. The unexpected advance of the Housing Market Index reflects increases in all three component indicators.

The index measuring current sales conditions jumped to 87 in October from 82 in September, the graph gauge of potential buyers' movement rose to 65 from 61 and the component measuring sales expectations in the next six months rose to 84 from 81.

Commenting on the figures, NAHB Chief Economist Robert Dietz said: “Builders are increasingly concerned about future affordability hurdles for most buyers. The Federal Reserve is reducing its purchases of US Treasury securities and mortgage-backed debt. Policy makers should focus on repairing a disrupted supply chain. This will stimulate more construction and help relieve upward pressure on housing prices.”

Today, Tuesday, the US Department of Commerce is scheduled to issue a separate report on new residential construction in September. Housing starts are expected to rise to an annual rate of 1.620 million in September from 1.615 million in August, while building permits are expected to decline to a rate of 1.680 million from 1.728 million.

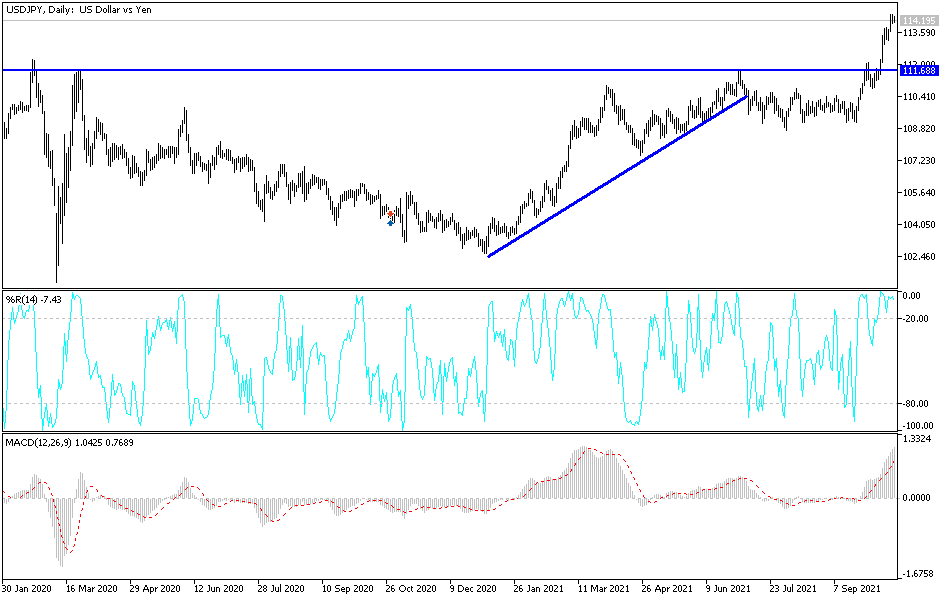

Technical analysis of the pair

So far, the general trend of the USD/JPY currency pair is still bullish, and there will be no reversal of the general outlook without a move towards the 113.20 support and below the 112.00 support. I still confirm that, according to the performance on the daily chart, the pair's gains have moved the technical indicators towards strong overbought levels, and I expect profit-taking to start any time now.

The closest resistance levels for the bulls are currently 114.65, 115.20 and 116.00.