The USD/JPY pair has been trying to break through the 112.00 psychological resistance again, which strengthens the current bullish outlook for the pair. As I mentioned before, the US dollar will maintain its upward momentum against the rest of the other major currencies until the US job numbers are announced tomorrow, which in turn directly affect expectations of raising US interest rates that support the US dollar. The USD/JPY is stable around the 111.40 level, and yesterday's gains extended to the 111.78 resistance.

One of the main pillars of the strength of the US dollar in 2021 was the assumption that the Fed would start its exit from quantitative easing before raising the interest rate in 2022. Accordingly, the yield paid on US government bonds has risen as investors expect a combination of higher inflation and higher Fed rates, attracting interest from foreign investors hungry for positive returns and the offer of US security bonds.

The inflows of capital from foreign investors in turn pushed up the dollar and this dynamic will continue to emerge until other central banks commit to raising interest rates.

Employment in the US private sector increased more-than-expected in September, according to a report by the payroll processor ADP which confirmed that US private sector employment jumped by 568,000 jobs in September after rising by 340,000 downwardly revised jobs in August. Economists had expected the US private sector employment rate to rise by 428,000 jobs, compared to an addition of 374 thousand jobs originally reported for the previous month.

Commenting on the figures, ADP Chief Economist Nella Richardson said: "The labor market recovery continues to make progress despite the marked slowdown from the 748,000 jobs in the second quarter. The current bottlenecks in employment should abate as health conditions associated with the COVID-19 variant continue to improve, paving the way for solid job gains in the coming months.".

Job growth in the private sector was stronger than expected in part due to the significant increase in employment in the leisure and hospitality industry, which added 226,000 jobs. Employment in the goods-producing sector also increased by 102,000 jobs amid increases in both construction and manufacturing jobs. The report also showed that employment in large companies increased by 390 thousand jobs, while medium-sized companies added 115 thousand jobs and employment opportunities in small companies increased by 63 thousand jobs.

Tomorrow, Friday, the US Labor Department is set to release its monthly report on the state of the closely watched labor market, which includes both public and private sector jobs. Economists now expect US hiring to increase by 488,000 jobs in September after rising by 235,000 jobs in August. The country's unemployment rate is expected to fall to 5.1% from 5.2%.

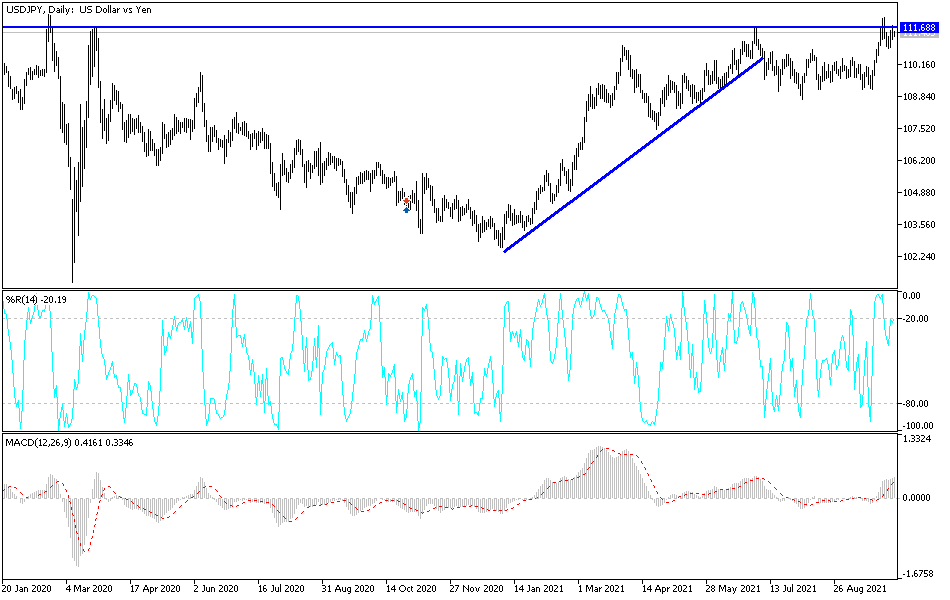

Technical analysis of the pair

The general trend of the pair will remain bullish as long as it is stable above the 110.00 psychological resistance. The continuation of the current momentum does not rule out moving towards the resistance levels at 112.25, 112.90 and 113.30. It is clearly shown on the performance on the daily chart that the currency pair will not abandon the current bullish outlook, except with a move towards the 109.80 support level. Otherwise, the general trend will remain to the upside.

I do not expect a big change in the performance of the USD/JPY today, and all the focus of the markets is on tomorrow's data.