Risk appetite is not in favor of the safe-haven Japanese yen, which experienced sharp losses against the other major currencies. On Wednesday, the USD/JPY reached a 4-year high. The US dollar gained additional impetus from expectations of imminent tightening of the US Federal Reserve's policy.

Japan has become an amazing and somewhat mysterious success story of the COVID-19 virus. New daily COVID-19 cases have fallen from a mid-August peak of nearly 6,000 in Tokyo, as the number of cases in the densely populated capital routinely fell below 100, an 11-month low.

Japan, unlike other places in Europe and Asia, hasn't had anything close to lockdowns, just a series of relatively toothless emergencies. Some of the possible factors in Japan's success include a delayed but remarkably rapid vaccination campaign, the evacuation of many nightlife areas as concerns spread during the recent surge in cases, and a common practice, well before the epidemic, of wearing masks and bad weather in late August, which kept people at home. But with the vaccine's efficacy gradually waning as winter approaches, experts worry that without knowing the exact reason for the drop in cases so dramatically, Japan may face another wave like this summer, when hospitals were overwhelmed with serious cases and deaths - although the numbers were less than previous waves.

The number of daily vaccinations rose to about 1.5 million in July, raising vaccination rates from 15% in early July to 65% by early October, surpassing 57% in the United States.

The Japanese Ministry of Finance said on Wednesday that Japan posted a merchandise trade deficit of 622.8 billion yen in September. It missed expectations of a deficit of 519.2 billion yen following the downwardly revised deficit of 637.2 billion yen in August (originally -635.4 billion yen). Exports rose 13.0 percent on an annual basis, topping expectations for an increase of 11.0 percent after a 26.2 percent increase in the previous month.

Imports rose 38.6 percent on an annual basis versus expectations of a 34.4 percent gain and a slowdown from 44.7 percent in the previous month.

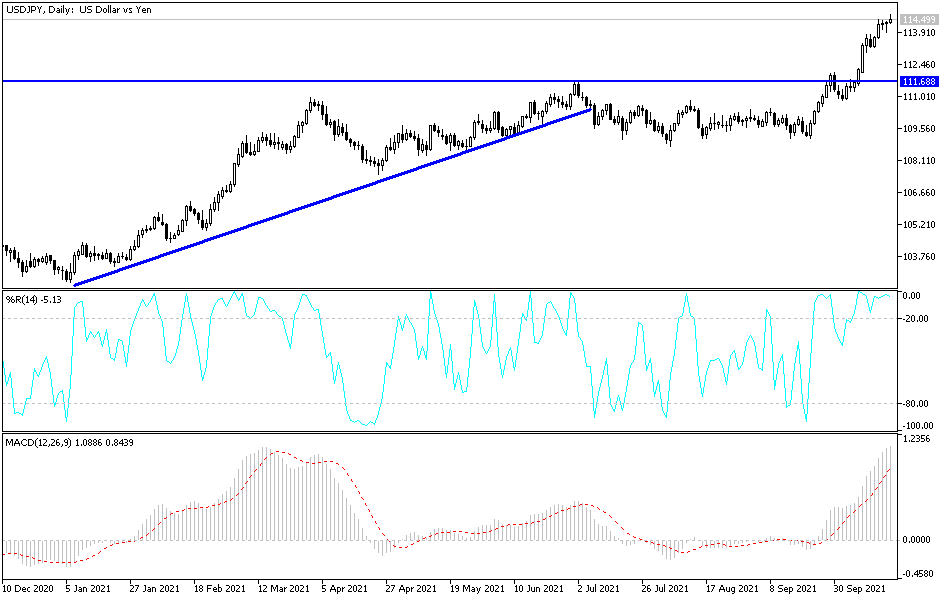

Technical analysis of the pair

Despite the completion of the upward path, the recent gains of the USD/JPY pair pushed the technical indicators towards strong overbought levels, and soon profit-taking may commence. The closest targets for the bulls are currently 114.85, 115.20 and 116.00. On the downside and according to the performance on the daily chart, the first reversal of the general trend would be if the currency moves to the support levels at 112.80 and 111.90. So far the general trend of the currency pair is still bullish.

Today's economic calendar is devoid of important US economic data. Therefore, the move will depend on risk appetite and the economic divergence and monetary policy between Japan and the United States.