Despite US jobs figures coming in below expectations, the USD/JPY completed the upward path and hit the resistance level of 112.25 by the end of last week. This was the highest level for the currency pair since April 2019, and the pair closed trading stable near it.

Employers are struggling to find enough workers, so the month's gains amounted to 194,000 jobs - not even half of what economists had expected. In August, the US economy added a total of 366,000 jobs. Taken together, employment over the past two months represents a sharp decline from 962,000 jobs added in June and 1.1 million in July.

The US labor market has experienced extreme volatility since the COVID-19 virus hit the US beginning in March 2020, resulting in a brief but severe recession that wiped out 22 million jobs. Since then, employers have added 17 million jobs back as huge amounts of federal aid pushed money into people's pockets, and the rollout of vaccines has given many the confidence to return to stores, restaurants and bars — at least before the emergence of the delta variant.

Last month, private sector firms added 317,000 jobs, down from 332,000 in August and from the January-to-July average of 553,000. The leisure and hospitality sector, which includes hotels, restaurants and bars hardest hit by the pandemic, added 74,000 jobs. And while that number is up from 38,000 in August, it is well below the January-July average of 296,000 per month.

Friday's employment news wasn't all bad. The US Department of Labor revised its employment estimates for the months of July and August, increasing the total of 169,000 jobs. The country's unemployment rate fell to 4.8% in September from 5.2% in August.

From January to July of this year, employers added an astounding average of more than 640,000 jobs per month. Then COVID cases started to rise again and the economic recovery weakened. Job growth slowed in August and September. Since mid-September, though, confirmed COVID cases have declined, potentially paving the way for a labor market recovery to regain momentum.

From Japan, the forecast for the September Eco Watchers survey beat expectations by 45.8 with a score of 56.6, while the Eco Watchers Current poll beat expectations by 21.1 with a reading of 42.1. Japan's August employment earnings and non-seasonally adjusted current account balance beat expectations. On the other hand, the total household spending and the trade balance both miss the estimates.

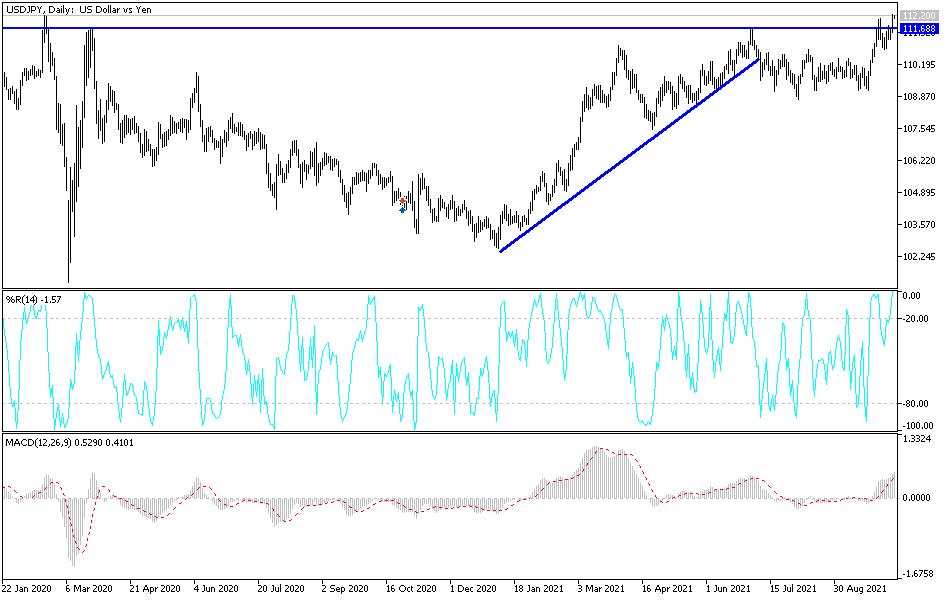

Technical analysis of the pair

In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within the formation of a sharply bullish channel. As a result, the pair rose to overbought levels on the 14-hour RSI. Therefore, the bears will target potential pullback profits at around 111.85 or lower at 111.51. On the other hand, the bulls will target short-term profits around 112.51 or higher at 112.83.

In the long term, according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of an ascending channel. The currency pair has now risen near the overbought levels of the 14-day RSI. Therefore, the bulls will target potential channel breakout profits around the 113.24 resistance or higher at the 114.56 resistance. On the other hand, the bears will target long-term profits at around support 110.93 or lower at support 109.29.