The bullish path of the USD/JPY stopped at the 113.80 resistance as soon as the US Federal Reserve indicated that it may abandon bond purchases in the first half of 2022 if the economic performance continues to improve. The USD/JPY is stable around the 113.50 level as of this writing. The Fed is widely expected to announce the tapering at its next meeting, which will be held on November 2-3. It is likely that the announcement will be made before the tapering off actually begins. If so, such a move would be the Fed's first step to undo the efforts it has made to stimulate the economy in the wake of the pandemic.

“Participants generally assessed that provided the economic recovery remains broadly on track, a tapering off process that ends in the middle of next year is likely to be appropriate,” read the minutes of the bank’s latest meeting, which was issued yesterday.

Last December, the US Federal Reserve said it would buy $120 billion in bonds a month until the US economy makes "significant progress" toward its goals of maximum employment and inflation averaging 2% over time. Bond purchases are intended to stimulate more borrowing and spending by keeping long-term interest rates low. The Fed also pegged the short-term reference rate at nearly zero.

Before announcing the minutes of the Federal Reserve, another jump in consumer prices in September sent US inflation up 5.4% from a year earlier, matching the biggest increase since 2008 as tangled global supply lines continue to wreak havoc.

US consumer prices rose 0.4% in September from August with higher prices for new cars, food, gas and restaurant meals.

The Labor Department said yesterday that the annual increase in the CPI matches the June and July readings at the highest level in 13 years. Excluding the volatile food and energy categories, core inflation rose 0.2% in September and 4% year over year. Core prices hit a three-decade high of 4.5% in June.

Continued price gains are adding to pressure on the Federal Reserve, whose officials have repeatedly said the increases will be temporary, and on US President Joe Biden, who faces an economy slowing in job gains and rising inflation. Republicans accused Biden of spurring inflation with the $1.9 trillion rescue package that took effect in March of this year.

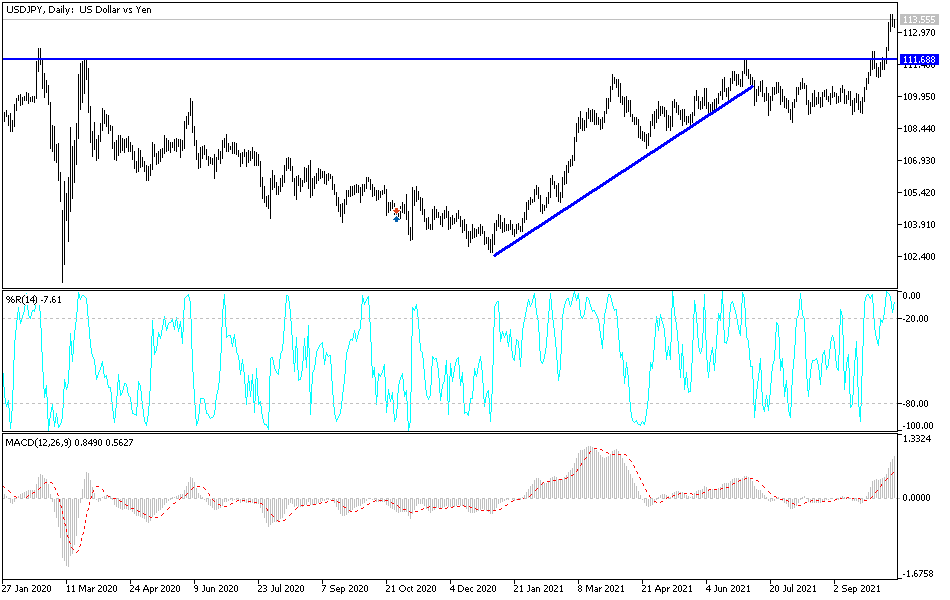

Technical analysis of the pair

For three trading sessions in a row, the USD/JPY has been finding reasons to go bullish, which confirms that the technical indicators have reached overbought levels. Unless the pair gains more momentum, selloffs may occur. The closest targets for the bulls are 114.00, 114.55 and 115.20. On the downside, the pair will leave the current ascending channel by moving towards the support levels 111.60 and 110.40. Otherwise, the general trend will remain bullish.

The USD/JPY currency pair will be affected today by risk appetite and the reaction to the weekly jobless claims announcement and the PPI reading.