For the fourth day in a row, the USD/JPY is undergoing profit-taking after its recent gains. The buying and selling operations pushed the currency pair towards the 113.41 support, where it has settled near as of this writing. The gains of the bullish rebound pushed the USD/JPY towards the 114.70 resistance level, its highest since trading in 2018.

The strong gains of the US dollar in the Forex market were prompted by expectations that the US Federal Reserve will abandon its stimulus plans for the US economy to address the effects of the coronavirus, and the results of inflation data and the US labor market supported those expectations. On the other hand, Japan is facing a weak rate of vaccination against the pandemic, as well as signs of a slowing economy due to the energy crisis and disruption of global supply chains.

The US Markit Preliminary Manufacturing PMI for October fell from expectations at 60.3 with a reading of 59.2. On the other hand, the Services PMI beat expectations of 55.1 with a reading of 58.2, while the Composite PMI - which includes the manufacturing and services sectors together - beat expectations of 54.7 with a reading of 57.3. Last week's initial US jobless claims exceeded expectations by 300,000 with a reading of 290K while continuing claims for the previous week exceeded expectations by 2.55 million with a reading of 2.481 million.

On the other hand, the White House is considering a tax on the investment income of billionaires — fewer than 1,000 of the wealthiest Americans with at least $1 billion in assets. It also floated a 15% minimum corporate tax rate designed to ensure all companies pay what Biden calls their "fair share" — despite the fact that the top 1% already pay 40% of the country's tax revenue. Democrats initially planned that Biden's package would include $3.5 trillion in spending and tax initiatives over 10 years. But the demands of the moderates led by Manchin and Sinema to contain costs mean its final price could be less than $2 trillion.

A weak Japanese yen is usually a boon to the export-oriented Japanese economy. But when combined with rising crude oil and raw materials prices, it leaves the economy facing a double whammy that is set to impede economic recovery from the pandemic. The yen's recent slide to a nearly four-year low against the US dollar coupled with US oil prices rising to a seven-year high threatens to cut household spending even as the impact of COVID-19 continues to be felt. The combination is also set to make the difference between companies that have enjoyed a recovery from the fallout from the pandemic and those that have not, economists say.

The weak yen has pushed up prices for imported products such as oil, putting Japan at serious risk at a time when the resource-scarce country saw import prices rise at the fastest pace in four decades last month. Wholesale prices also rose sharply, testing the affordability of Japanese companies that chose to absorb higher costs rather than pass them on to consumers. Some food and gasoline prices are already starting to rise to put pressure on consumer spending.

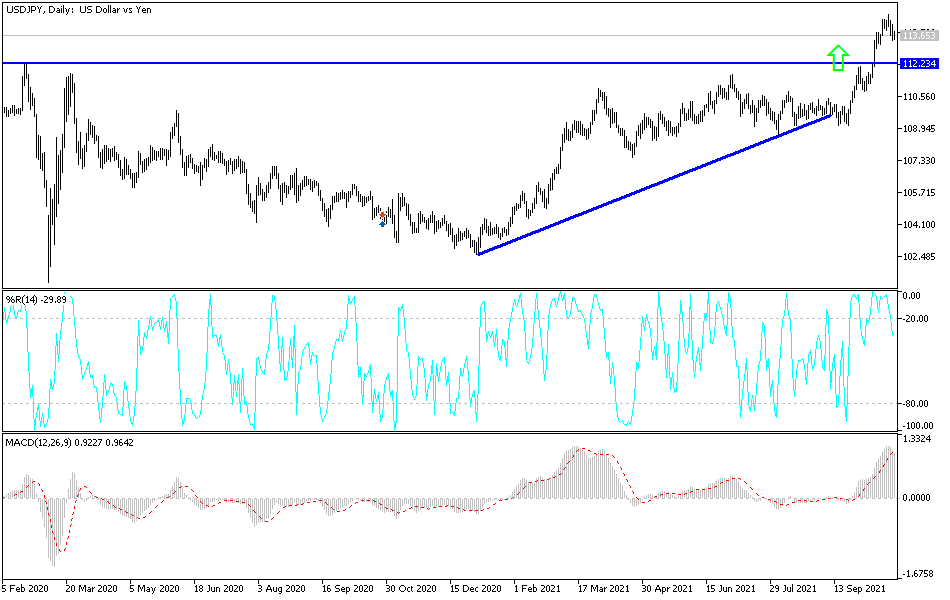

Technical analysis of the pair

In the near term, according to the performance on the hourly chart, it appears that the USD/JPY is trading within the formation of a descending channel. This indicates significant short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 113.25 or lower to the 112.98 support. On the other hand, the bulls will target potential bounces around 113.71 or higher at 113.98.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp bullish channel. This indicates a strong long-term bullish momentum in market sentiment. Therefore, the bulls will look to ride the current ascending wave towards the 114.51 resistance or above to the resistance 115.80. On the other hand, the bears will target long-term pullbacks at around support 112.26 or lower at support 110.93.